A Case for Not Waiting for Interest Rates to Drop

Contents

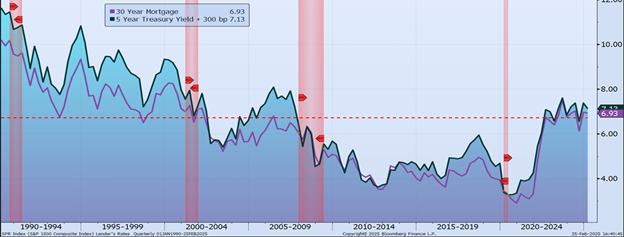

There has been much debate about whether the rising loan interest rates over the last five years (in some cases almost by 200%) are the primary driver of the real estate affordability problem. However, as shown in the chart above from Bloomberg, today’s rates are nearly identical to the 35-year average, shown as the dotted red line, and are lower than they were 30 years ago.

Rates History

Following the Great Recession of 2007, interest rates were intentionally lowered to historic levels and kept down for an extended period to encourage a slow and steady economic recovery.

This prolonged period of low rates became the norm for consumers. As the US economy recovered post-COVID, interest rates began to rise, returning to a much healthier and more sustainable economic balance for both borrowers and savers.

Illustrated in the chart above from Bloomberg, since 2020, the price of an average home increased at twice the rate of US household incomes. This trend of rapid appreciation is also evident in the commercial real estate market. These price increases drove real estate tax assessments and replacement costs higher, thus increasing the price of hazard, wind and flood insurances, which were already being plagued by recent acts of Mother Nature. These factors suggest that the real estate affordability challenge is driven more by the increases in real estate prices, property taxes and insurance costs, than solely by increased in interest rates.

The Bottom Line

Today’s rates are not inflated and are optimal for a healthy economy. If you are waiting for rates to drop significantly before making a real estate purchase, you might be waiting until the next historical economic downfall.

Buy Now, Refi Later

However, if you are eyeing a new home or operating location for your business, but are concerned about rates falling after you purchase, Crews Bank & Trust offers the perfect solution. Our Buy Now, Refi Later* program, available for both residential and commercial mortgages, allows you to secure a onetime rate adjustment within 24 months after your closing, with only a small administration fee.

This program helps take the guess work out of timing the rates market and allows you to purchase the right property with confidence today.

If you are interested in our Buy Now, Refi Later program but still have questions, we are here for you! Stop in to your favorite Crews Bank & Trust branch, give us call or reach out to us online. We are happy to help you finance your next property at the best rates, now and later.

*The Buy Now, Refi Later benefit applies to Crews Bank & Trust purchase mortgages that close with at least 20% down. Subject mortgage must be in a first lien position. The Buy Now, Refi Later benefit is subject to revision or revocation by Crews Bank & Trust at any time without notice. Other conditions apply. Loans subject to credit approval. NMLS #406389

About the Author

James Coalwell, Vice President, Commercial Banker

James began his banking career in 1994, joined Crews Bank & Trust in 2020 and has over two decades of experience in lending and finance, holding leadership roles both in his native Minnesota and Florida. He holds a Bachelor of Science in Finance, along with advanced banking and leadership training from the Florida School of Banking and the Graduate School of Banking at LSU. Deeply committed to his community, James actively serves on multiple local boards and volunteers with organizations such as Habitat for Humanity.