Personal Checking

Open Your New Checking Account in Minutes

Open your checking or savings account online in minutes.

Already a Crews Bank & Trust Customer? Sign in to your online banking to skip the verification process and open your new account faster.

New Customers - Have these ready before you start:

• A photo of your Driver's License or Passport to upload.• Personal information, including your Social Security Number and Date of Birth.

• A way to fund your account - a credit card or an outside checking account number and routing number.

Early Access Checking

Waiting for your paycheck and paying overdraft fees is a thing of the past with the new Early Access Checking account from Crews Bank & Trust!

Key Features

- Early Access to Direct Deposits: Plan your finances with ease and greater flexibility. Get access to your paycheck as soon as possible, up to two days earlier1 than a traditional checking account.

- No Overdraft Fees: Use your account with confidence without being charged for overdrafts.2

- No Sweep Fees for Overdrafts: Experience peace of mind knowing there is no fee for moving funds by linking your Crews Bank & Trust checking or savings accounts. If you overdraw your Early Access Checking account, your linked account(s) will automatically cover the difference.3

- Free Online & Mobile Banking: Access your account anytime, anywhere through Crews Bank & Trust's secure online banking platform and mobile app. You can easily manage accounts, deposit checks, pay bills, send money with Zelle, and more, all from your mobile device, at your leisure.

- Local Customer Service: Connect with Florida-based banking experts through secure messaging in the mobile app, over the phone, and in-person.

- Access to over 55,000 ATMS: No additional cost to withdraw cash within our network of over 55,000 surcharge free ATMs across the United States.4

How to Open an Early Access Checking Account

- Online: Apply online through our secure website and get your account set up in less than five minutes.

- In-Branch: Visit any Crews Bank & Trust branch to open your account with the assistance of our friendly staff. Be sure to ask for an Early Access Checking account.

- Customer Support: Contact us at 888-406-2220 or support@crews.bank for any questions or assistance with the application process.

1Early availability of direct deposits may vary and is not guaranteed. Early direct deposit is a service that comes with your Early Access Checking account in which we credit your eligible direct deposit transaction up to two business days early. You must set up direct deposit to your account. The timing of when these transactions will be credited is based on when the payer submits the information to us. This means when these transactions are credited could vary and you may not receive your funds early. Eligible transactions are certain ACH credit transactions such as payroll, government benefits or similar transactions. Other deposits or credits to your account, such as deposits of funds from person-to-person payment services including Zelle®, Venmo, or PayPal transfers check or mobile deposits, and other online transfers or electronic credits are not eligible.

2 While this account generally prevents overdrawing, there may still be instances where your balance becomes negative. This can occur if a transaction is initially approved for a certain amount, but the final charge exceeds the available funds in your account. For example, if you use your debit card to pay for a meal and then add a tip, the total charge may result in a negative balance. However, we will not charge you an overdraft fee in such cases.

3 This service helps cover your payments and purchases, avoiding overdrafts and fees by automatically transferring funds from your linked backup account when needed. If your linked backup account does not have sufficient funds, we will decline the transfer.

4 We have partnered with Allpoint and Presto! to bring our customers access to a fee-free network of ATMs. Simply go to our Locations page to locate the ATM nearest to you anytime you have the need for cash.

NOT ALL CHECKING IS CREATED EQUAL. TRUST US, THAT’S A GOOD THING.

Get the checking account that can keep up with your busy Florida lifestyle. Each of our accounts features exclusive services for easily managing your income and expenses, wherever your next adventure takes you.

Each checking account includes:

-

Online Banking with Bill Pay1

-

Visa Debit Card with self-service fraud alerts and controls

-

Visa Debit Card with automatic fraud monitoring

-

24-hour Automated Telephone Banking Service

-

Person-to-Person Payments through Zelle®5

-

Free access to more than 55,000 ATMs6

-

Unlimited Check Writing

Other Checking Accounts Available

|

Monthly Maintenance Charges

button

|

|||

1 Some restrictions may apply. Minors aged 16 and 17 require a joint account with parent or guardian. You must be age 18 or older to access Bill Pay.

2 Mobile App required. Cell phone provider may charge additional fees for web browsing and/or text messages. In order to use Mobile Banking, the browser on your mobile device must be capable of storing cookies.

3 Subject to eligibility. Deposits are subject to verification. Deposit limits and other restrictions apply. Must have the Mobile App downloaded to your smart phone. Must retain check for seven days prior to destroying it. Check images will not be available online, for copies contact Customer Engagement.

4 Requires Visa Check Card. Some features require specific hardware and software.

5 P2P Payments can be made directly in Online Banking or the Mobile Banking App through the Zelle® network.

6 We have partnered with Allpoint and Presto! to bring our customers access to a fee-free network of ATMs. Simply go to our LOCATIONS PAGE to locate the ATM nearest to you anytime you have the need for cash.

Overdraft Coverage

Life happens! We at Crews Bank & Trust understand that from time to time you may unexpectedly overdraft your account. Returned checks can be costly. Overdraft Coverage can help.

Blog

On Our Minds

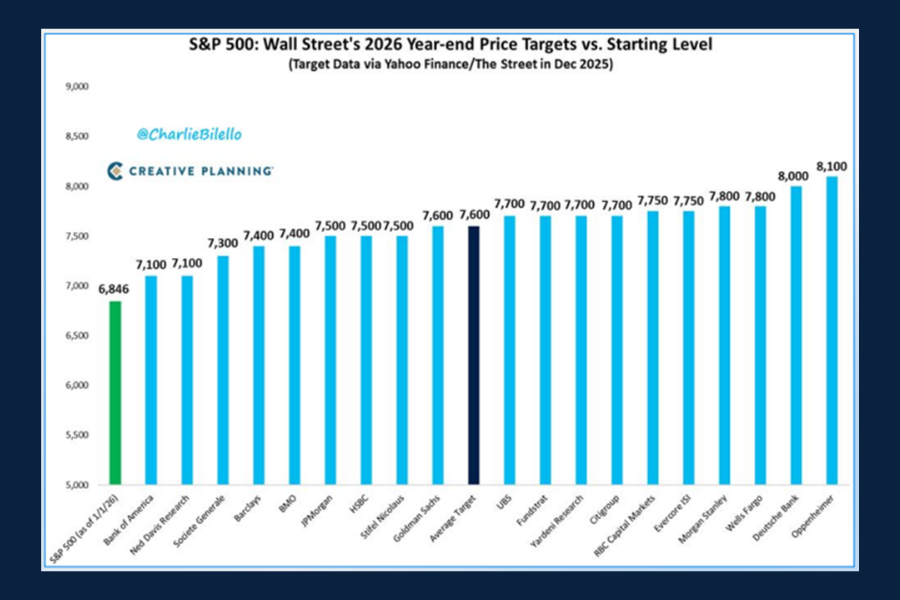

Chart of the Day: S&P 2026 Year End Price Targets

March 5, 2026

Today’s Chart of the Day, shared by Charlie Bilello, highlights year‑end price targets for the S&P 500 as forecasted by major Wall Street banks.

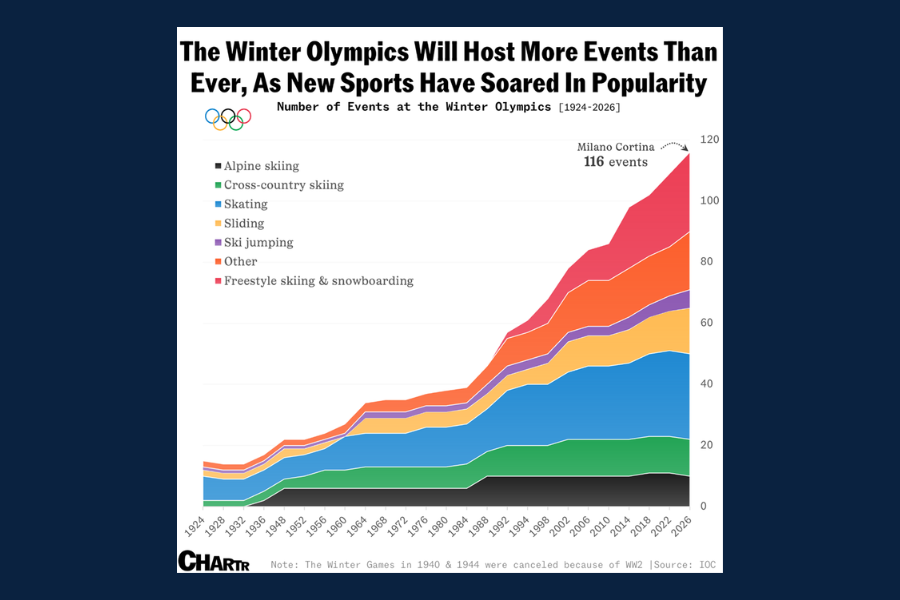

Chart of the Day: Winter Olympic Events

March 3, 2026

Following the conclusion of the 2026 Winter Olympics, today’s Chart of the Day comes from Chartr, highlighting the expansion of the Winter Games...