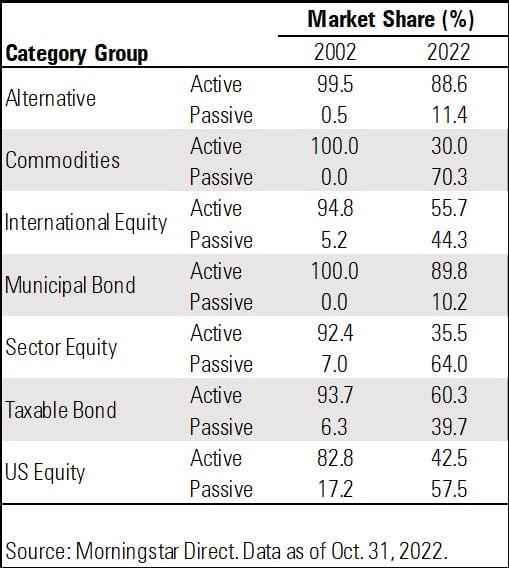

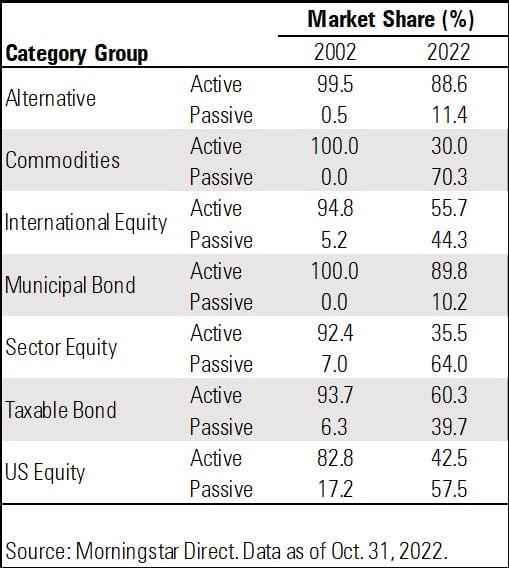

Change of Market Shares

Plan Today. Protect Tomorrow. Attend an Educational Estate-Planning Seminar.

Production of the U.S. penny has officially ended. Learn what this means for you.

Today’s Chart of the Day comes from @MorningstarInc and @MstarBenJohnson on Twitter. It shows the change from actively to passively managed investments over the last 10 years.

We often talk about this shift from active to passive, but it's interesting to see that it is not uniform throughout the different types of investments. For instance, in “alternative” investments such as private equity, hedge funds, and long-short funds, the industry’s use of passive investments only went from 1% to 11%.

In commodities, however, passive investments went from 0% to 70%. I suspect passive works better in commodities since the alpha, the opportunity to outperform, is low and low costs are a primary driver of returns.

We primarily use Taxable Bonds and US Equity, and they went from 6% to 40% and 17% to 57%, respectively. Again, primarily from the low alpha and low costs.

It will be interesting to see what the percentages are in 2032.

Experienced professionals from our wealth management services team can help you achieve a bright financial future through investment strategies tailored to you. We’ll show you all of the options available and help you choose the ones best suited to you. We’ll provide high-quality, personal service as we work toward your goals together. Our Portfolio Managers do not receive commissions on trades; our recommendations of investments are based solely on your best interests.

Investments are not a deposit or other obligation of, or guaranteed by, the bank, are not FDIC insured, not insured by any federal government agency, and are subject to investment risks, including possible loss of principal.