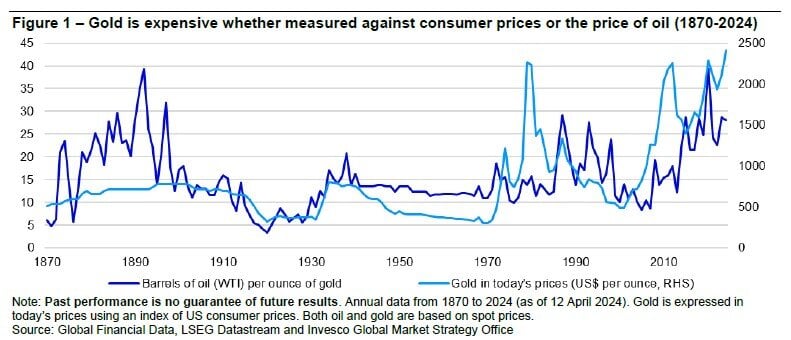

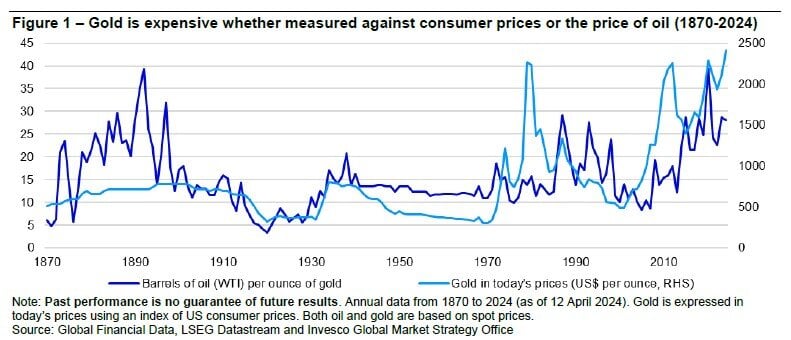

Chart of the Day: Gold vs. Oil

Plan Today. Protect Tomorrow. Attend an Educational Estate-Planning Seminar.

Production of the U.S. penny has officially ended. Learn what this means for you.

Today’s Chart of the Day is for my gold bugs. It is provided by Invesco and shows one way that investors use to value gold is to compare it to the price of oil, which is another commodity where the price is affected by geopolitical risk, inflation, and economic instability.

The chart goes back to 1870 and the past appears to be a good predictor. As of today, gold’s recent 14% year-to-date return may make it overpriced. However, as with all things, the opposite argument can be made that oil is the one that is undervalued. Whatever the outcome, the divergence between the two does not linger long, signaling that there may be some volitivity in the price of both in the short term.

Experienced professionals from our wealth management services team can help you achieve a bright financial future through investment strategies tailored to you. We’ll show you all of the options available and help you choose the ones best suited to you. We’ll provide high-quality, personal service as we work toward your goals together. Our Portfolio Managers do not receive commissions on trades; our recommendations of investments are based solely on your best interests.

Investments are not a deposit or other obligation of, or guaranteed by, the bank, are not FDIC insured, not insured by any federal government agency, and are subject to investment risks, including possible loss of principal.