Winning is Hard, Staying a Winner is Even Harder

Plan Today. Protect Tomorrow. Attend an Educational Estate-Planning Seminar.

Production of the U.S. penny has officially ended. Learn what this means for you.

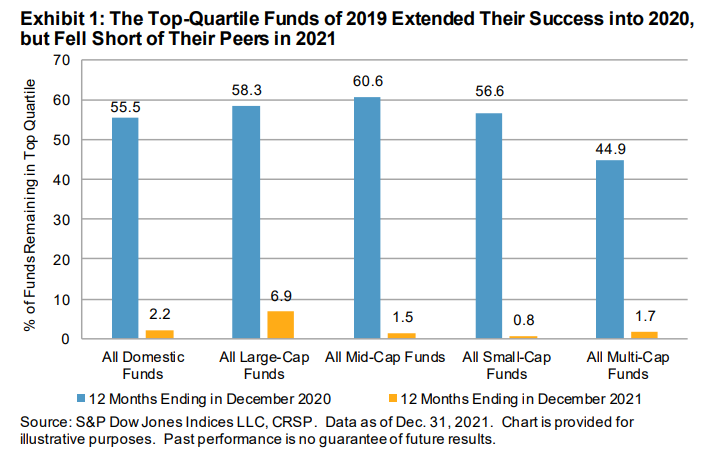

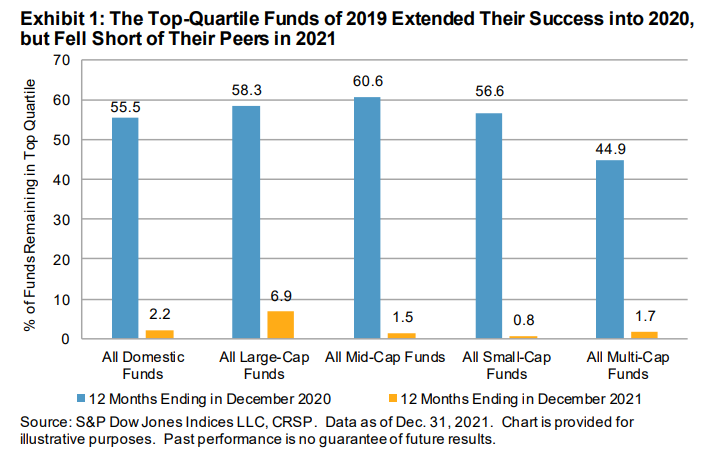

S&P Dow Jones Indices has published their updated U.S. Persistence Scorecard. A mere 2.2% of actively managed U.S. domestic equity funds in the top quartile for 12 months performance at the end of 2019 stayed ahead of three-quarters of their peers when measured two years later. Spurring their summary, “regardless of asset class or style focus, active management outperformance is typically short-lived, with few funds consistently outranking their peers or benchmarks.”

Simple chance would say the normal probability would be 50% of the funds the first year, then 25% the second. This mere 2% is worse odds than flipping a coin—so much so investors have better odds buying the losers, and selling the winners each year.

Another metric showing the perils of using active management.

Experienced professionals from our wealth management services team can help you achieve a bright financial future through investment strategies tailored to you. We’ll show you all of the options available and help you choose the ones best suited to you. We’ll provide high-quality, personal service as we work toward your goals together. Our Portfolio Managers do not receive commissions on trades; our recommendations of investments are based solely on your best interests.

Investments are not a deposit or other obligation of, or guaranteed by, the bank, are not FDIC insured, not insured by any federal government agency, and are subject to investment risks, including possible loss of principal.