Unlock Exclusive Mortgage Rates

For a limited time, we're offering rates 1 percentage point lower than most competitors.

5.522% APR*

4.786% APR*

*Terms and conditions apply. Contact us for details.

Request a Free, No Obligation Rate Quote:

Loans subject to credit approval. NMLS #406389

Rates 1.00% lower than most competitors:

| Rate | APR | Loan Amount | Down Payment | Monthly Payment | |

| 30-Year Fixed | 5.50% | 5.522% | $360,000 | 20% | $2,044.04 |

| 20-Year Fixed | 5.25% | 5.279% | $360,000 | 20% | $2,425.84 |

| 15-Year Fixed | 4.75% | 4.786% | $360,000 | 20% | $2,800.19 |

Estimated rates and monthly payments shown are for primary residence conventional loans and include principal and interest. Taxes and insurance premiums are not included. Your actual payment obligation will be higher. Mortgage rates valid as of Sept. 15, 2025, and are subject to change without notice. Additional terms and conditions apply. Construction-to-Permanent, Jumbo, and Second Home rates may be higher. Please contact a Crews Bank & Trust mortgage specialist for full details and to determine your eligibility.

These special rates are for customers of Crews Bank & Trust with deposit accounts, Online Banking, and recurring automatic deposits (such as payroll or retirement). Not yet a customer? Open an account today!

This offer applies to 30, 20, and 15-year fixed-rate mortgage loans with a 20% down payment for primary and secondary residences only. Manufactured homes and lot loans are excluded. A minimum credit score of 700 is required. Loans subject to credit approval. NMLS #406389

Why Choose Crews Bank & Trust?

- Flexible Mortgage Options: Purchase, Refinance, Construction-to-Permanent Loans and Jumbo Loans are available

- Local, Personalized Service: Fast decisions made right here in your community

- Exclusive Builder Partnerships: Builder credits available to help buy down rates even further

How to Get Started:

Contact us or start your application online!

Local Lending Expertise for Central & Southwest Florida

Central & Southwest Florida is anything but a “one-size-fits-all” housing market. Crews Bank & Trust calls this region home, and our mortgage team understands the nuances that can make-or-break your deal:

- Waterfront & Flood-Zone Financing – Navigating changing FEMA maps, wind-mitigation requirements, and specialized insurance costs.

- Rapid-Growth Markets – Helping buyers move quickly in competitive areas like Lakeland, Winter Haven, Bradenton/Sarasota, North Port, and Port Charlotte

- Condos & 55+ Communities – Mastering new Florida reserve-fund rules and HOA documentation.

- Rural & USDA Options – All of our branches can help with USDA loans for qualifying properties.

Why Borrowers Choose Crews Bank & Trust

- Local decisions, fast turnarounds. Your lender lives here in Florida - we understand the special needs of borrowers in Florida.

- Portfolio flexibility. From jumbo and construction-to-permanent loans and lot loans, we craft solutions that other lenders can’t.

- Personal guidance. Dedicated loan officers walk you through insurance, taxes, and closing costs unique to our coastline and climate.

Counties We Proudly Serve

Hillsborough | Pinellas | Pasco | Hernando | Citrus | Sumter | Polk | Manatee | Sarasota | Charlotte | Collier | DeSoto | Hardee | Highlands | Lee | — and every welcoming town throughout the region.

We know how important it is to buy a home you can call your own.

That’s why we offer a variety of mortgage loans with terms that fit your financial needs. Trust in our experienced team to ensure you go home to the home of your dreams.

Loans subject to credit approval. NMLS #406389

MORTGAGES

Whether you’re a first-time homebuyer or a seasoned home owner, we offer loan options with competitive rates and flexible terms.

Jumbo Loans

If you have your sights set on a high-value home, our experienced lenders make it easy to finance your luxury residence.

Construction

When you’re ready to build your dream home, our Construction-to-Permanent Loans will make the process easy with one application and one closing.

FHA

FHA loans provide more flexibility in guidelines and down payment requirements. Plus, they are government insured and can often help with purchasing your home.

Land/Lot

When you want to purchase a residential parcel to build your home on, we can help meet your financing needs.

Manufactured Homes

Are you ready to buy a manufactured home on owned land? Our mortgage experts are ready to help.

Investment Properties

Investing in residential homes? We can help with your investment.

Conventional Loans

For some borrowers, a conventional mortgage might be the best loan option.

Condo Loans

We offer both warrantable condo loans and non-warrantable condo loans for those condominium properties that don't meet conventional guidelines.

VA Loans

We proudly offer VA Loans exclusively for Veterans and Military Personnel. Thank you for your service.

Blog

On Our Minds

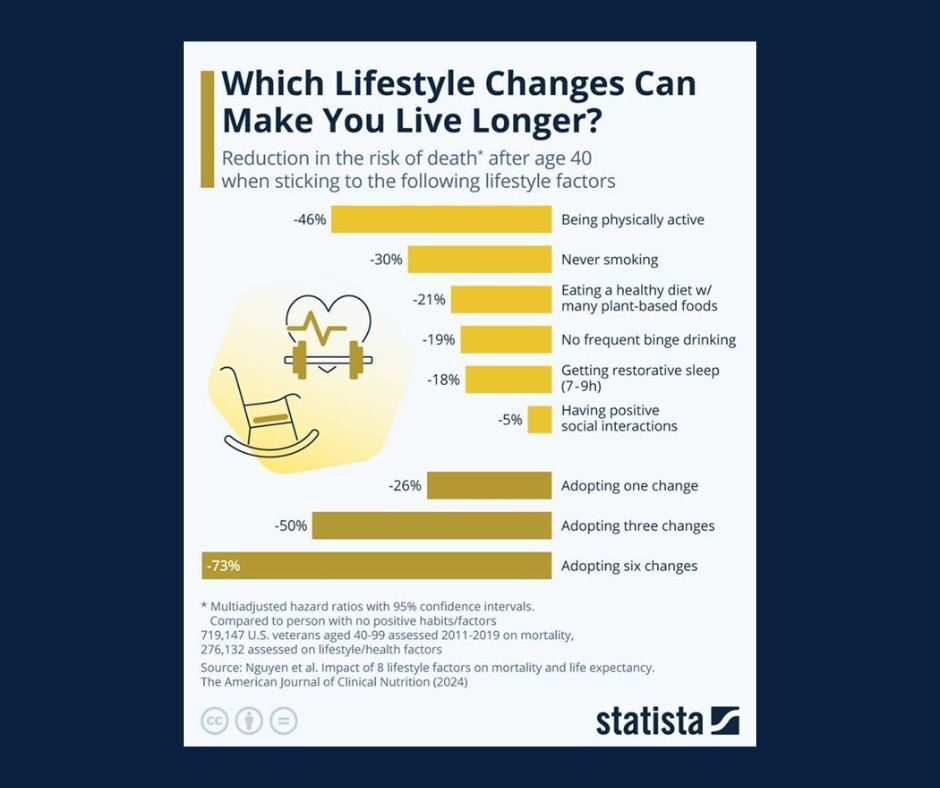

Chart of the Day: Lifestyle Changes for Longevity

February 19, 2026

Today's Chart of the Day from Statista highlights how everyday habits can meaningfully influence longevity, especially after age 40.

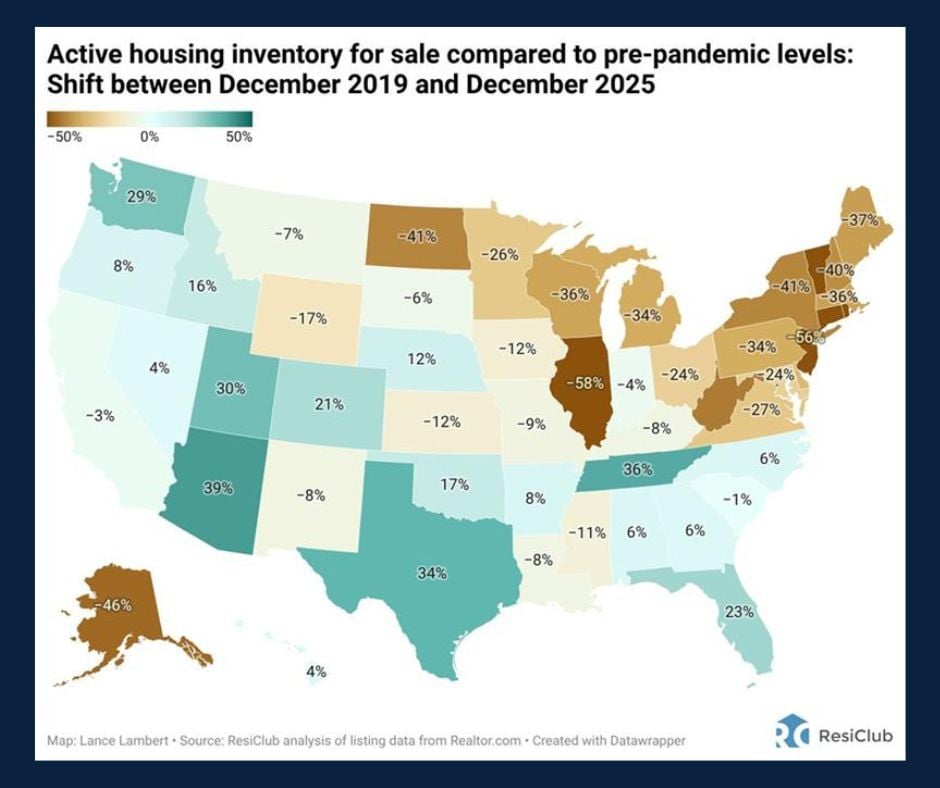

Chart of the Day: Housing Inventory

February 17, 2026

Today's Chart of the day from ResiClub illustrates how today’s housing inventory compares with pre‑covid levels.