Small- and Mid- vs. Large-Cap Stocks

Plan Today. Protect Tomorrow. Attend an Educational Estate-Planning Seminar.

Production of the U.S. penny has officially ended. Learn what this means for you.

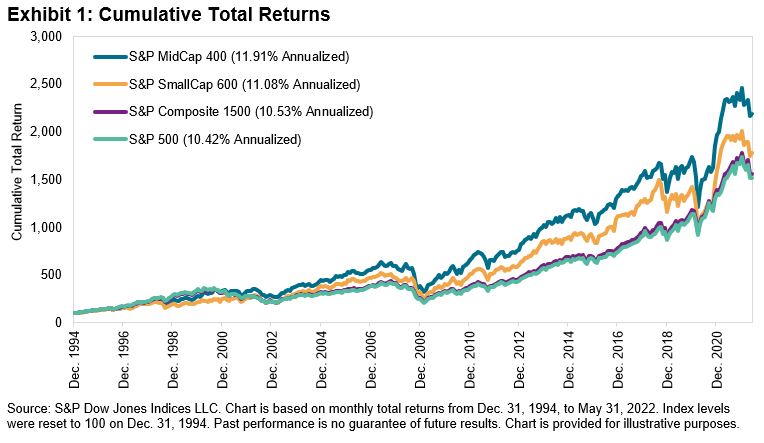

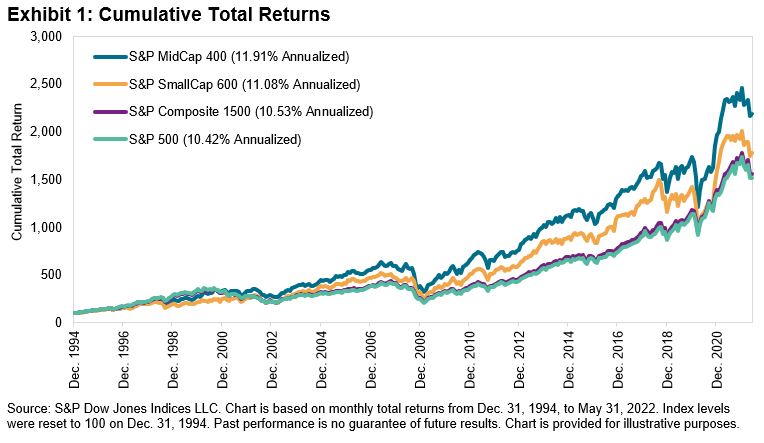

As of today, small- and mid-cap stocks on a year-to-date basis are performing better than their large-cap counterparts by 3% and 2%, respectively.

There is an ebb and flow but going all the way back to 1994 small- and mid-cap stocks have outperformed large-cap stocks by an annual 0.66% and 1.49%, respectively. Financial theory supports, and so far this year it is also true, that when you add them to your portfolio they lower your risk due to the additional diversification.

Since this follows our motto of obtaining the “highest returns, for the least amount of risk,” we include small- and mid-cap stocks in all our portfolios.

Experienced professionals from our wealth management services team can help you achieve a bright financial future through investment strategies tailored to you. We’ll show you all of the options available and help you choose the ones best suited to you. We’ll provide high-quality, personal service as we work toward your goals together. Our Portfolio Managers do not receive commissions on trades; our recommendations of investments are based solely on your best interests.

Investments are not a deposit or other obligation of, or guaranteed by, the bank, are not FDIC insured, not insured by any federal government agency, and are subject to investment risks, including possible loss of principal.