The Trouble with Treasuries

Plan Today. Protect Tomorrow. Attend an Educational Estate-Planning Seminar.

Production of the U.S. penny has officially ended. Learn what this means for you.

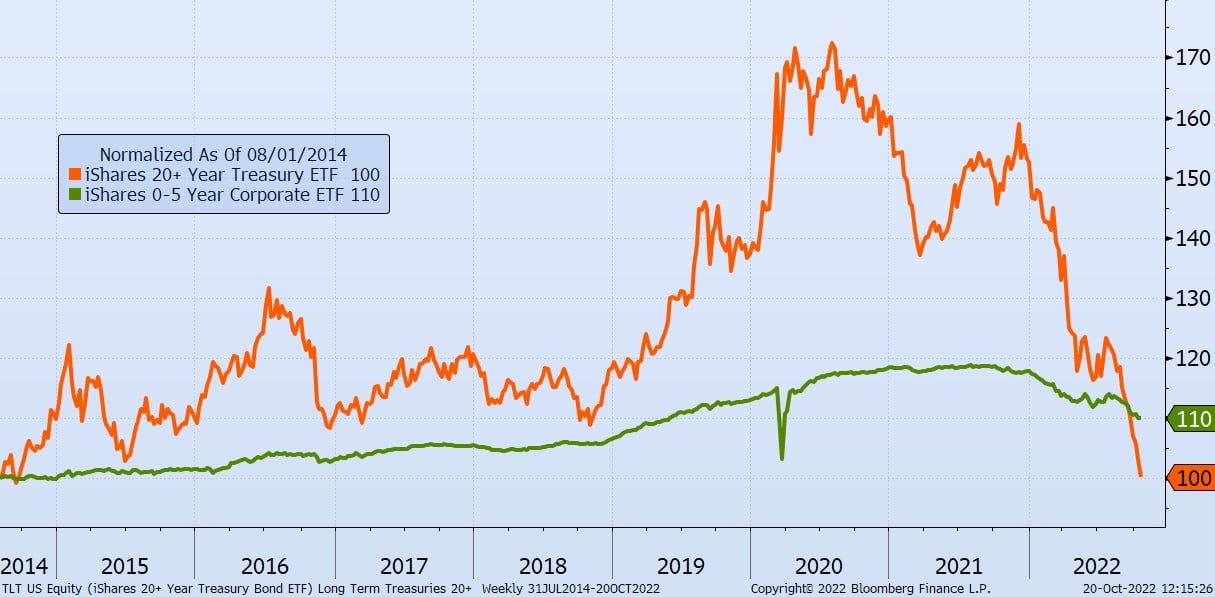

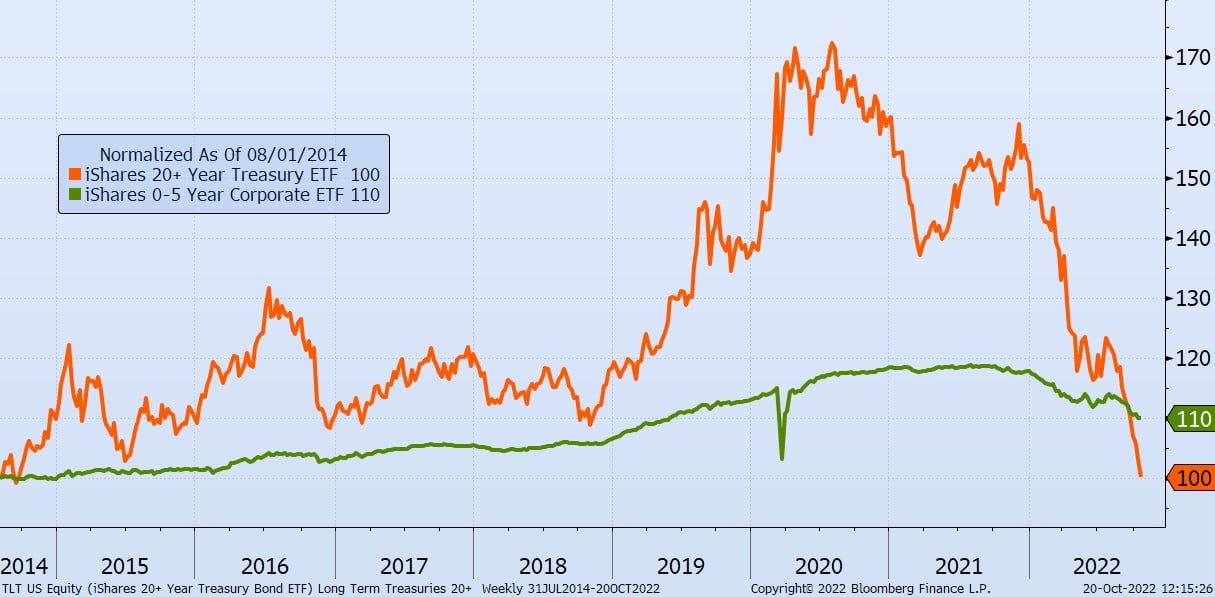

It’s been a challenging few years for Long-Term Treasury Bonds, which are defined as bonds that have maturities of 20+ years and are noted in orange on today's Chart of the Day. Since 2020, they have lost 42% of their value, erasing all the accumulated value for the last six years.

You may recall the theory that on a long enough timeline, many investments will have a similar risk adjusted return. In the short term, the green line highlights this idea. It is our largest bond holding, which consists of 0-5 Year Corporate Bonds. Over the same time period, it produced a slightly higher return with less volatility.

Then again, we don’t know how this match-up will end up since we’ll have to wait another 20+ years to see the outcome, since that is how long it will be before the last of the Long-Term Treasury Bonds mature.

Experienced professionals from our wealth management services team can help you achieve a bright financial future through investment strategies tailored to you. We’ll show you all of the options available and help you choose the ones best suited to you. We’ll provide high-quality, personal service as we work toward your goals together. Our Portfolio Managers do not receive commissions on trades; our recommendations of investments are based solely on your best interests.

Investments are not a deposit or other obligation of, or guaranteed by, the bank, are not FDIC insured, not insured by any federal government agency, and are subject to investment risks, including possible loss of principal.