Chart of the Day: One Third

Plan Today. Protect Tomorrow. Attend an Educational Estate-Planning Seminar.

Production of the U.S. penny has officially ended. Learn what this means for you.

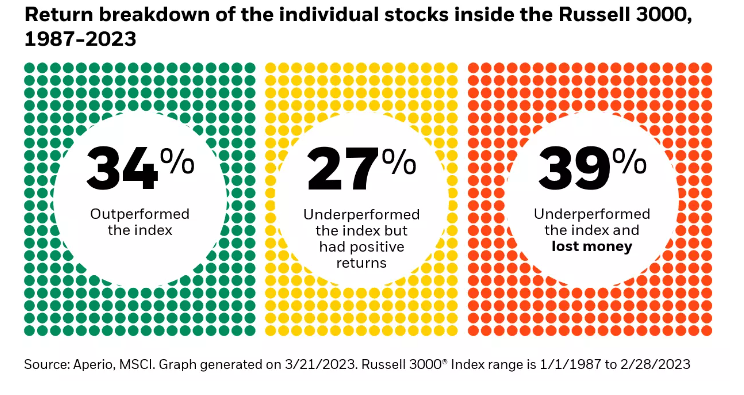

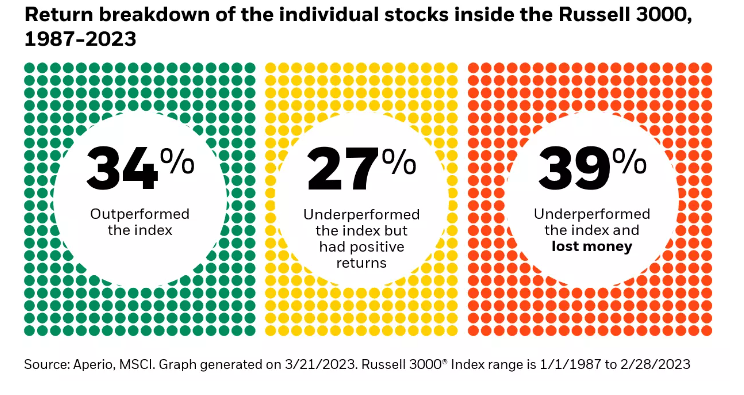

Today’s Chart of the Day from Aperio shows the percentage of individual stocks in the Russell 3000, which represents the 3,000 largest stocks in the US, and how they have performed since 1987. The performance is almost divided into thirds: 34% outperformed the overall index, 27% underperformed but had positive returns, and 39% lost money.

These statistics reinforce the Modern Portfolio Theory, a fundamental tenant of modern finance, by Harry Markowitz.* Quite simply, diversification is the name of the game. Since only 34% stocks outperform, it’s always better to own more stocks than less to make sure you own the right ones.

*I have a picture of both Harry Markowitz and Jack Bogle, founder and chief executive of The Vanguard Group, on my desk.

Experienced professionals from our wealth management services team can help you achieve a bright financial future through investment strategies tailored to you. We’ll show you all of the options available and help you choose the ones best suited to you. We’ll provide high-quality, personal service as we work toward your goals together. Our Portfolio Managers do not receive commissions on trades; our recommendations of investments are based solely on your best interests.

Investments are not a deposit or other obligation of, or guaranteed by, the bank, are not FDIC insured, not insured by any federal government agency, and are subject to investment risks, including possible loss of principal.