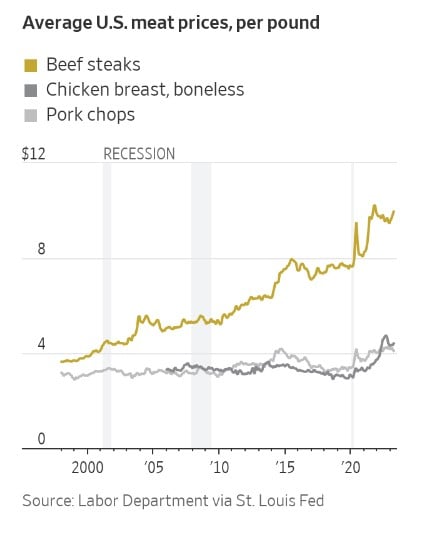

Chart of the Day: Beef vs. Pork

Today’s Chart of the Day from the Wall Street Journal shows that you aren’t imagining that beef prices have gone up. Beef prices have increased significantly versus chicken and pork since the pandemic.

Merry Christmas! We are open until 2 p.m. on Christmas Eve, Wednesday, Dec. 24. All of our locations will be closed on Thursday, Dec. 25.

Plan Today. Protect Tomorrow. Attend an Educational Estate-Planning Seminar

Today’s Chart of the Day from the Wall Street Journal shows that you aren’t imagining that beef prices have gone up. Beef prices have increased..

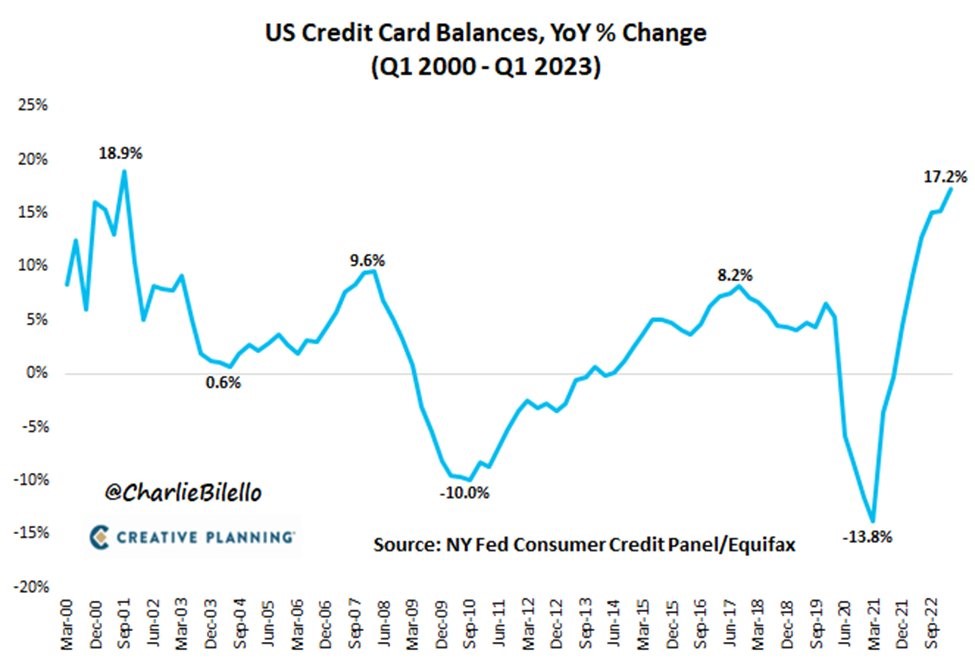

Today’s Chart of the Day from @CharlieBiello on Twitter shows the annual change in credit card balances dating back to 2000. The latest data shows a..

Election years can be unsettling times, as political campaigns dominate headlines and uncertainty looms in the air. It's common for individuals and..

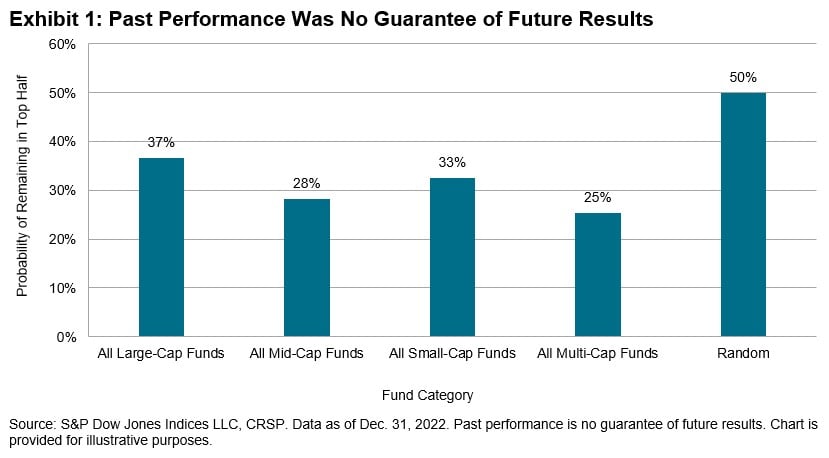

Today’s Chart of the Day comes from Craig Lazzara's article “Persistently Disappointing.” It asks if top fund managers outperform due to skill or..

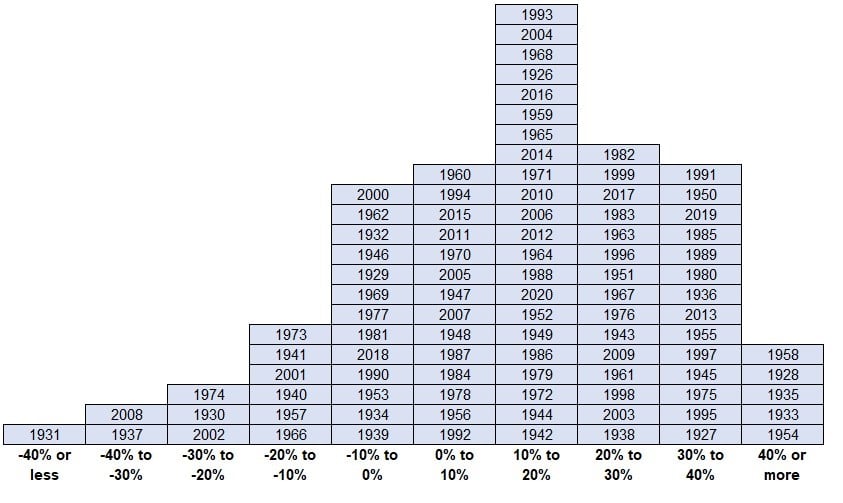

Today’s Chart of the Day comes from A Wealth of Common Sense showing the range of annual returns over the last 95 years. The long-term average is 10%..

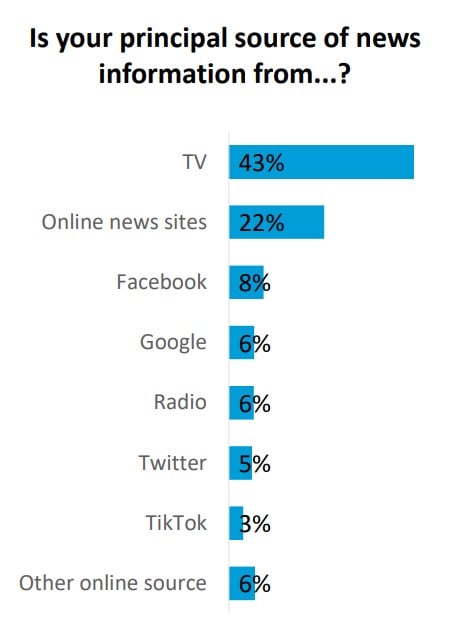

Today’s Chart of the Day is from the recent Harvard Caps/Harris poll. After all of these years, at 43%, TV is still the principal place people get..

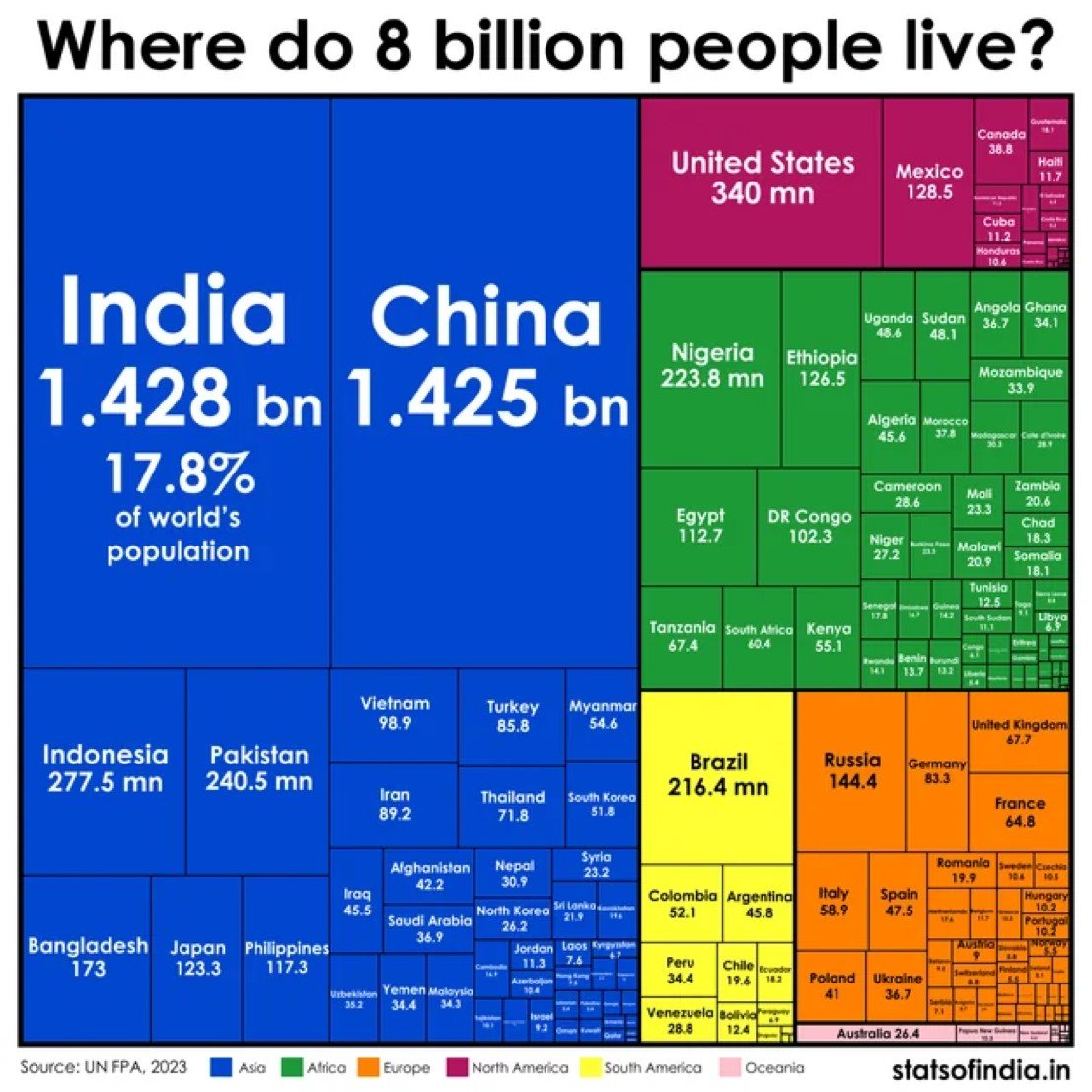

Today’s Chart of the Day comes from statsofindia.in with information from the United Nations Population Fund. It shows where everyone lives on earth.

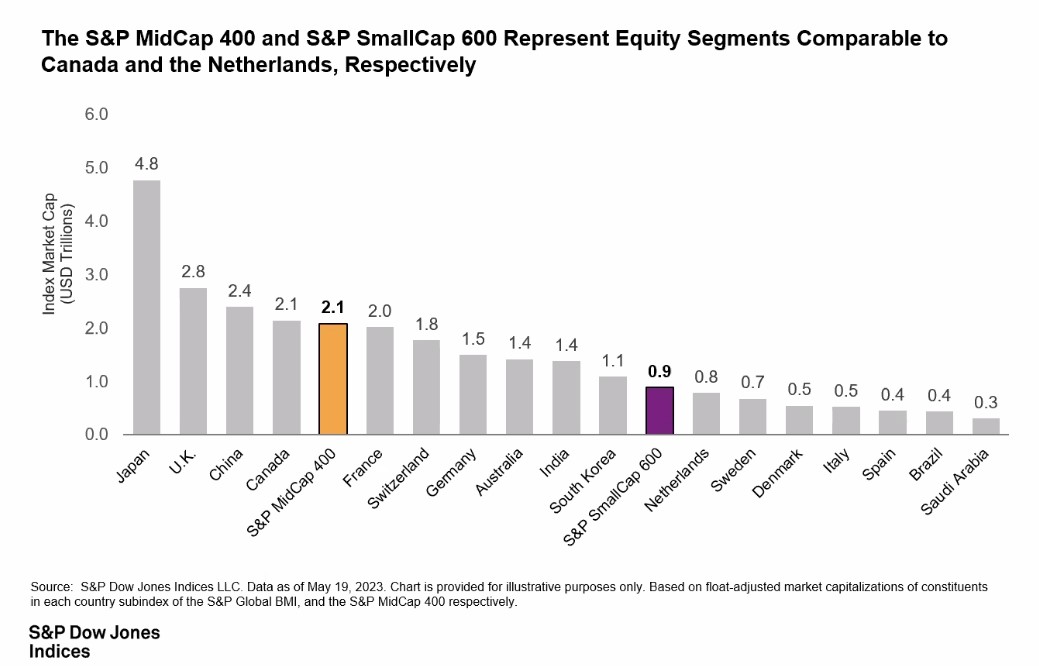

Today’s Chart of the Day from S&P Global shows the size of the United States S&P 400 Mid-Cap and S&P 600 Small-Cap Indexes vs. the size of other..

Today’s Chart of the Day from a Bloomberg article discusses Exxon Mobil's exclusion from the Dow Jones Industrial Average Index. The chart shows that..

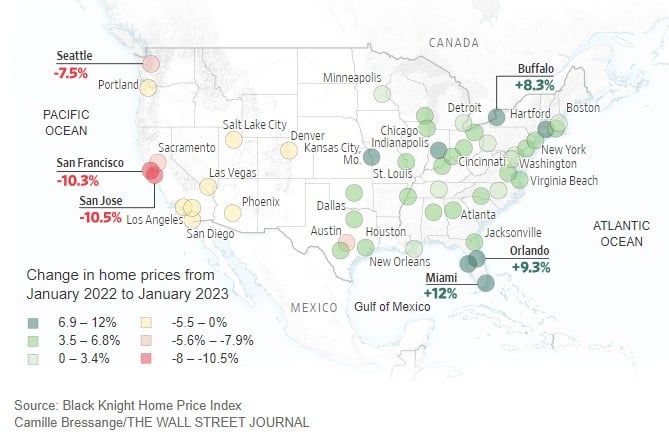

Today’s Chart of the Day from the Wall Street Journal shows that home prices are falling on the West Coast of the U.S. and rising in the East.

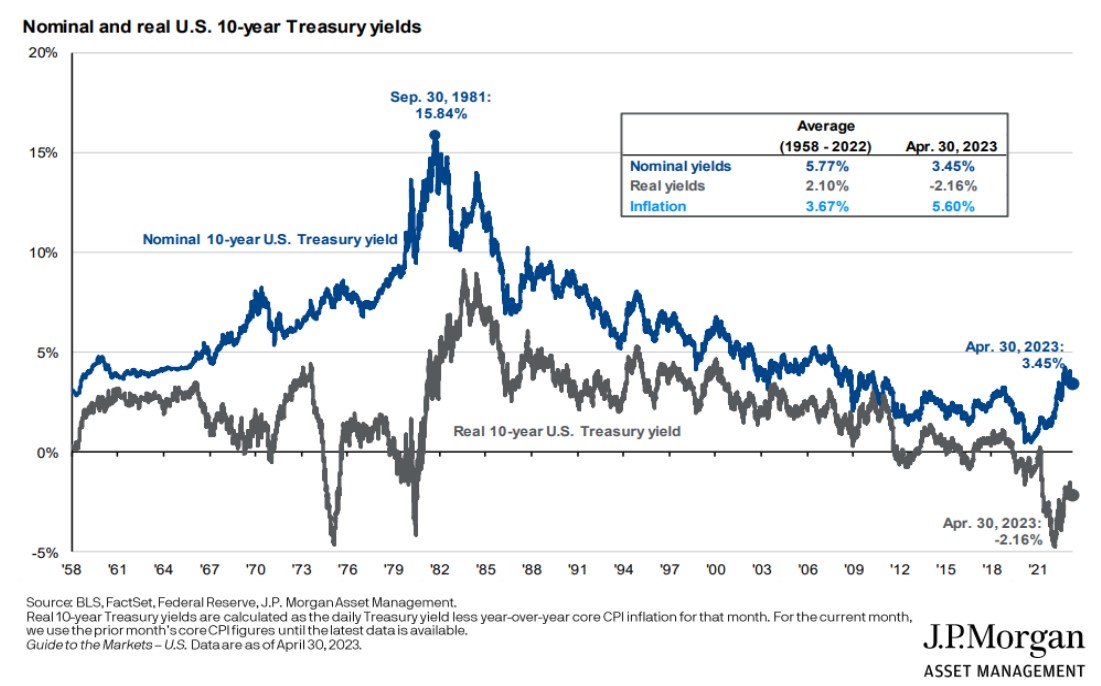

Today’s Chart of the Day from J.P. Morgan shows the history of the 10-year Treasury yield and the “real” yield, which is what you have left after you..

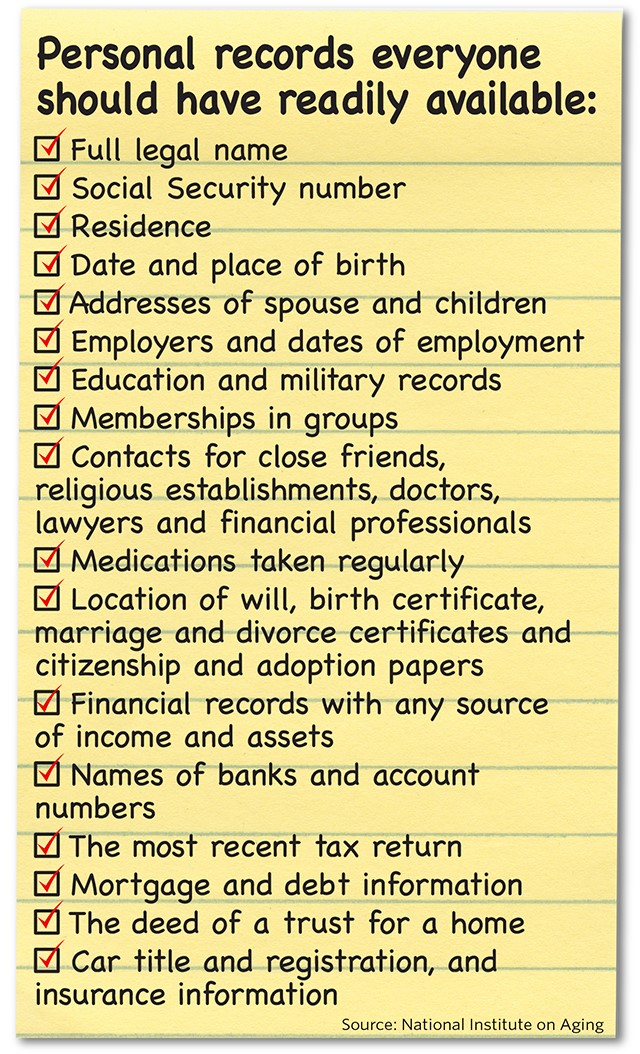

Today’s Chart of the Day is a great checklist from MarketWatch.com. As an example, I store this information in the notes of “My Card," in Contacts on..

Today’s Chart of the Day from the Financial Times shows that the U.S. currently makes up about half of the world's stock market.

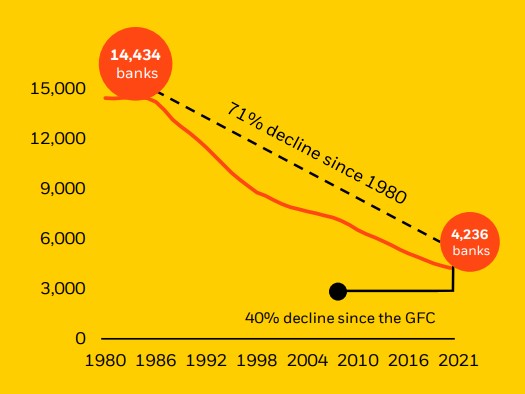

There used to be a bank on every corner; however, today’s Chart of the Day from BlackRock shows a 71% decline in US banks since 1980. Why?

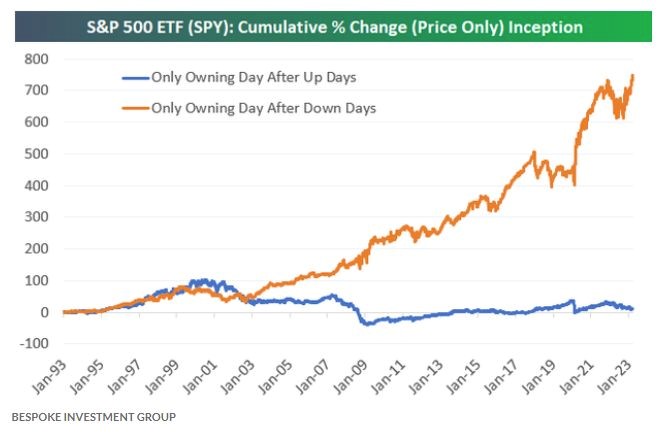

Today’s Chart of the Day from Bespoke shows the difference in price, excluding dividends, if you owned the S&P 500 only during the day after it went..

Samuel serves as Senior Vice President, Chief Investment Officer for the Crews family of banks. He manages the individual investment holdings of his clients, including individuals, families, foundations, and institutions throughout the State of Florida. Samuel has been involved in banking since 1996 and has more than 20 years experience working in wealth management.

Investments are not a deposit or other obligation of, or guaranteed by, the bank, are not FDIC insured, not insured by any federal government agency, and are subject to investment risks, including possible loss of principal.

Today’s Chart of the Day from the Wall Street Journal shows that you aren’t imagining that beef prices have gone up. Beef prices have increased significantly versus chicken and pork since the pandemic.

Today’s Chart of the Day from @CharlieBiello on Twitter shows the annual change in credit card balances dating back to 2000. The latest data shows a 17.2% increase, nearing the record set in 2001 at 18.9%. This is another unintended consequence of the COVID-19 pandemic response.

Election years can be unsettling times, as political campaigns dominate headlines and uncertainty looms in the air. It's common for individuals and businesses to feel anxious about the potential financial impacts that elections can bring. However, it's crucial to remember that maintaining financial confidence during these periods is essential for making informed decisions and achieving long-term financial goals. In this blog, we'll explore strategies and mindset shifts that can help instill financial confidence and empower you to navigate the uncertainty of an election year.

Today’s Chart of the Day comes from Craig Lazzara's article “Persistently Disappointing.” It asks if top fund managers outperform due to skill or good luck. In EVERY fund category and over EVERY time frame, it was found to simply be good luck.

Today’s Chart of the Day comes from A Wealth of Common Sense showing the range of annual returns over the last 95 years. The long-term average is 10% over the entire period.

Today’s Chart of the Day is from the recent Harvard Caps/Harris poll. After all of these years, at 43%, TV is still the principal place people get their news.

Today’s Chart of the Day comes from statsofindia.in with information from the United Nations Population Fund. It shows where everyone lives on earth.

Today’s Chart of the Day from S&P Global shows the size of the United States S&P 400 Mid-Cap and S&P 600 Small-Cap Indexes vs. the size of other country’s entire market value.

Today’s Chart of the Day from a Bloomberg article discusses Exxon Mobil's exclusion from the Dow Jones Industrial Average Index. The chart shows that out of the top 15 companies in the United States, more than half, noted in black, are excluded.

Today’s Chart of the Day from the Wall Street Journal shows that home prices are falling on the West Coast of the U.S. and rising in the East.

Today’s Chart of the Day from J.P. Morgan shows the history of the 10-year Treasury yield and the “real” yield, which is what you have left after you subtract inflation.

Today’s Chart of the Day is a great checklist from MarketWatch.com. As an example, I store this information in the notes of “My Card," in Contacts on my iPhone.

Today’s Chart of the Day from the Financial Times shows that the U.S. currently makes up about half of the world's stock market.

There used to be a bank on every corner; however, today’s Chart of the Day from BlackRock shows a 71% decline in US banks since 1980. Why?

Today’s Chart of the Day from Bespoke shows the difference in price, excluding dividends, if you owned the S&P 500 only during the day after it went up the previous day (blue) vs. owning it after it went down the previous day (orange).

current_page_num+2: 20 -