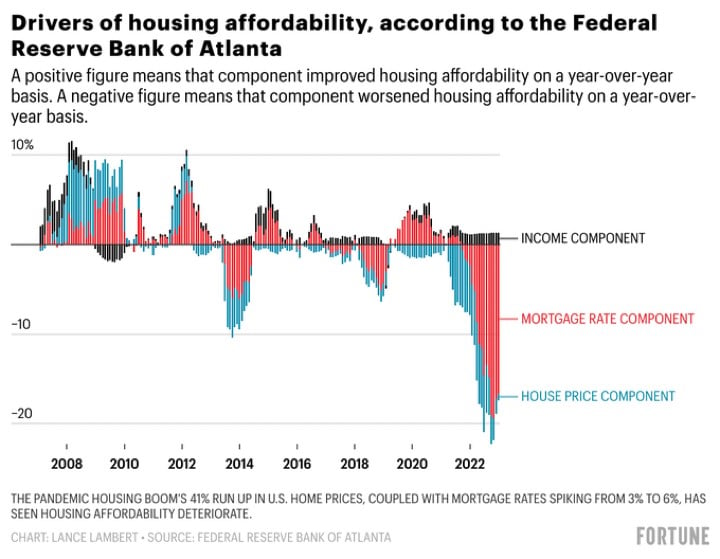

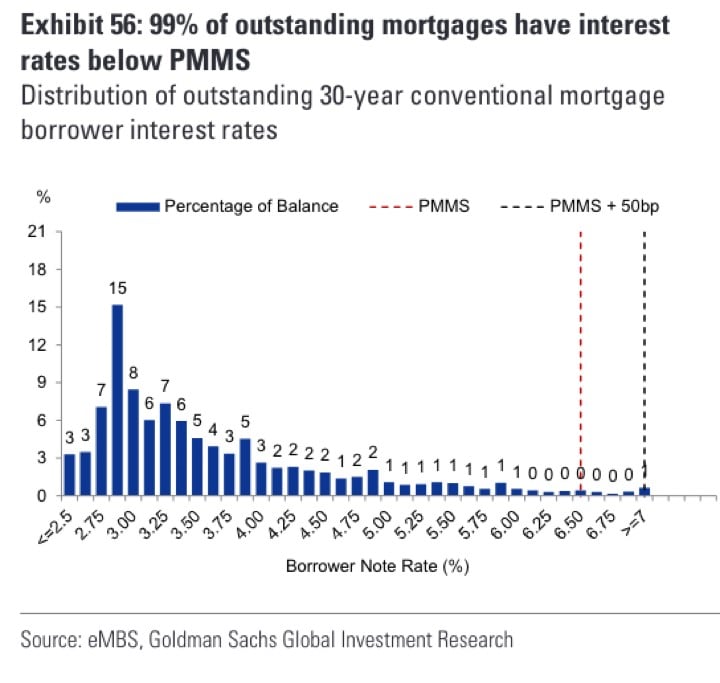

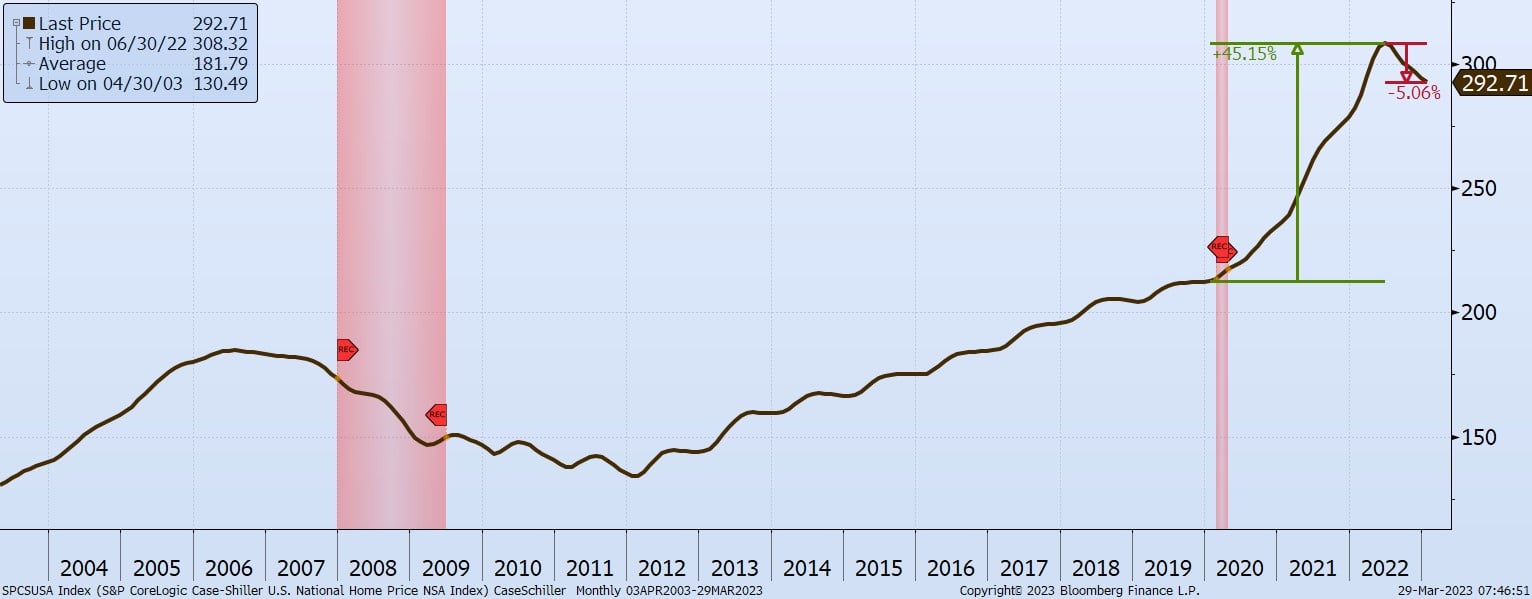

Chart of the Day: Housing Affordability

Today's Chart of the Day from Fortune illustrates the components of housing affordability, which include changes in incomes, rates, and prices. There is an ebb and flow, but currently rates are the primary driver.