A Case for Not Waiting for Interest Rates to Drop

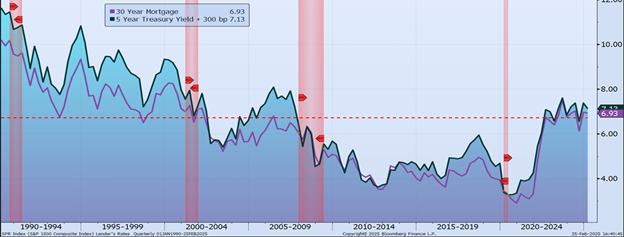

There has been much debate about whether the rising loan interest rates over the last five years (in some cases almost by 200%) are the primary driver of the real estate affordability problem. However, as shown in the chart above from Bloomberg, today’s rates are nearly identical to the 35-year average, shown as the dotted red line, and are lower than they were 30 years ago.