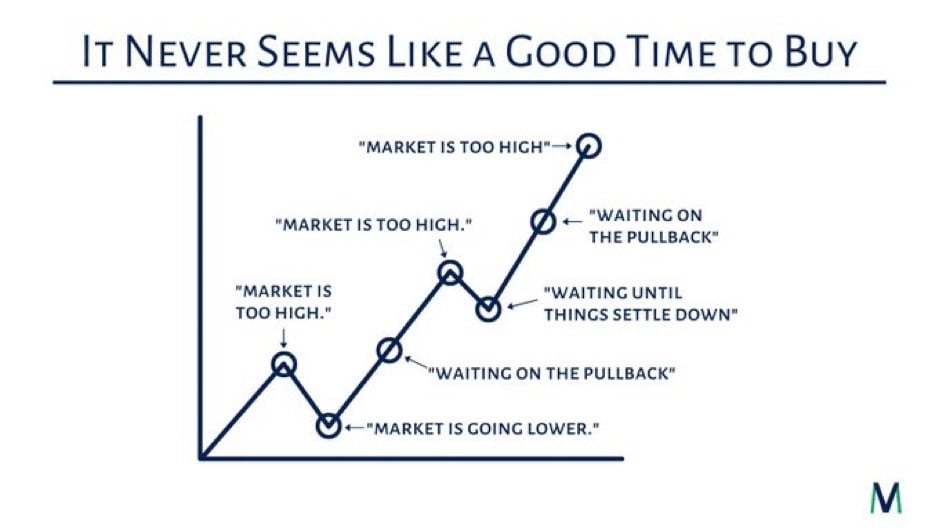

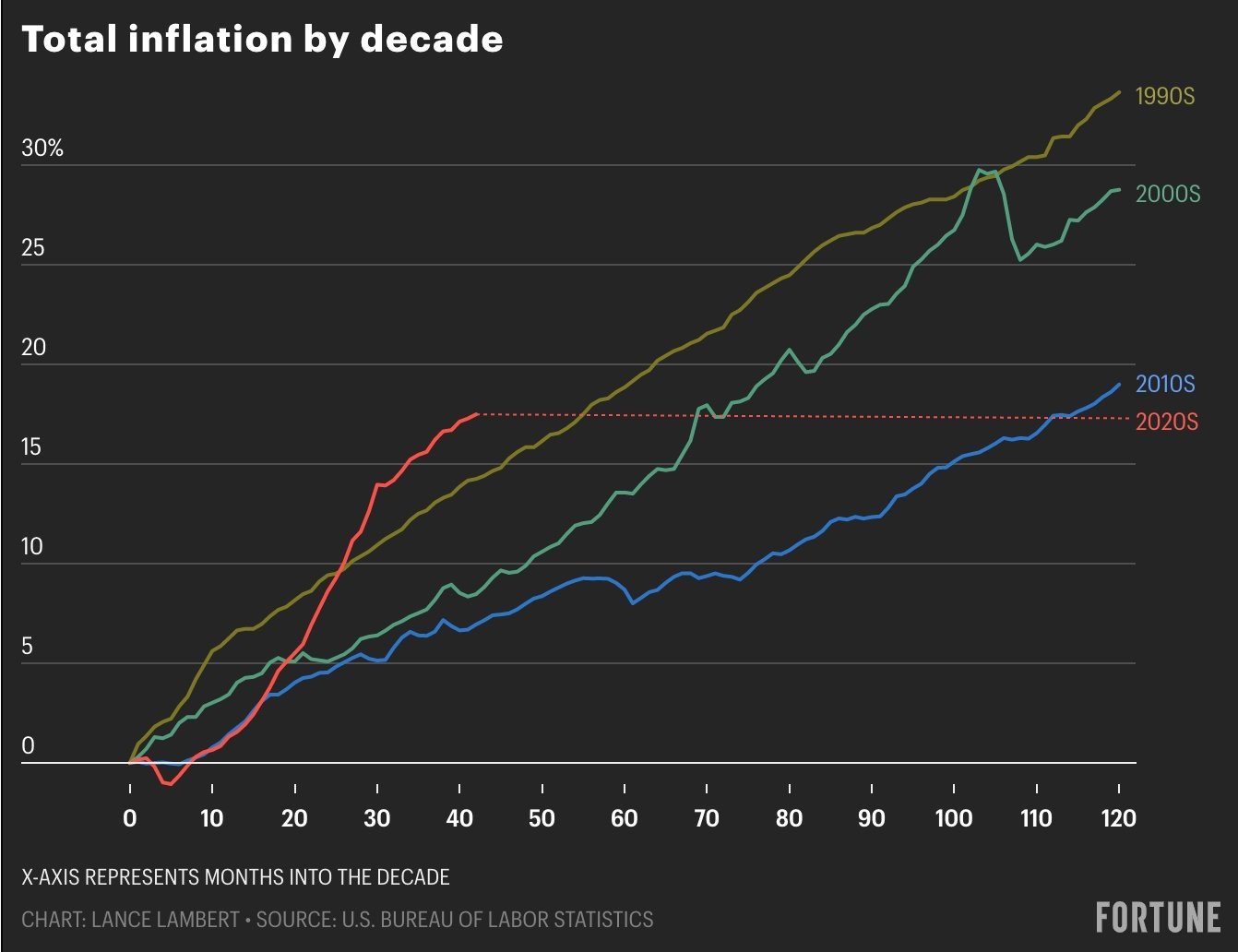

Chart of the Day: Good Time to Buy

Today’s Chart of the Day from @MVMoneyVisuals on X, formerly known as Twitter, sums up many of the comments heard by advisors over the years. On a long enough timeline, there has never been a bad time to own stocks for the long-run.

.jpg)