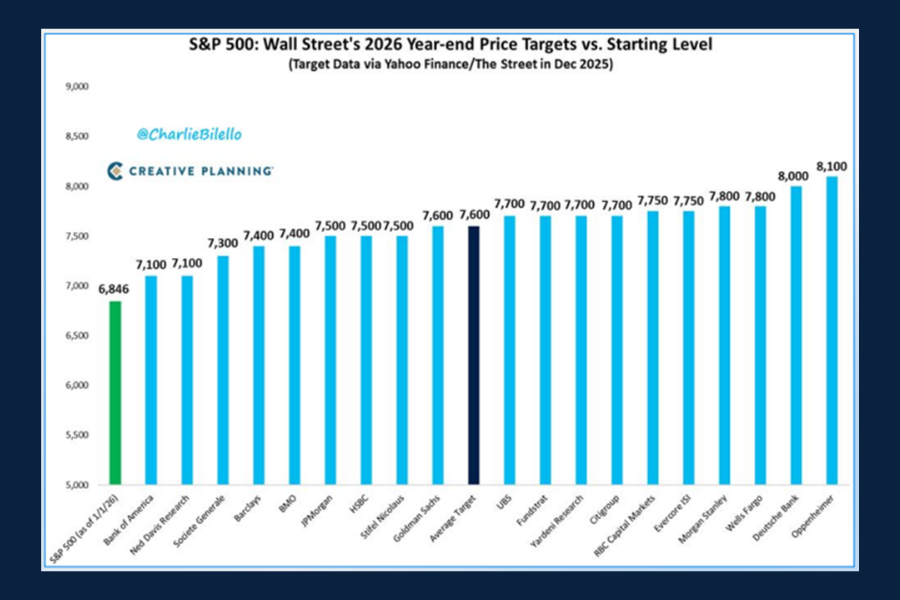

Chart of the Day: S&P 2026 Year End Price Targets

Today’s Chart of the Day, shared by Charlie Bilello, highlights year‑end price targets for the S&P 500 as forecasted by major Wall Street banks.

Plan Today. Protect Tomorrow. Attend an Educational Estate-Planning Seminar.

Production of the U.S. penny has officially ended. Learn what this means for you.

Today’s Chart of the Day, shared by Charlie Bilello, highlights year‑end price targets for the S&P 500 as forecasted by major Wall Street banks.

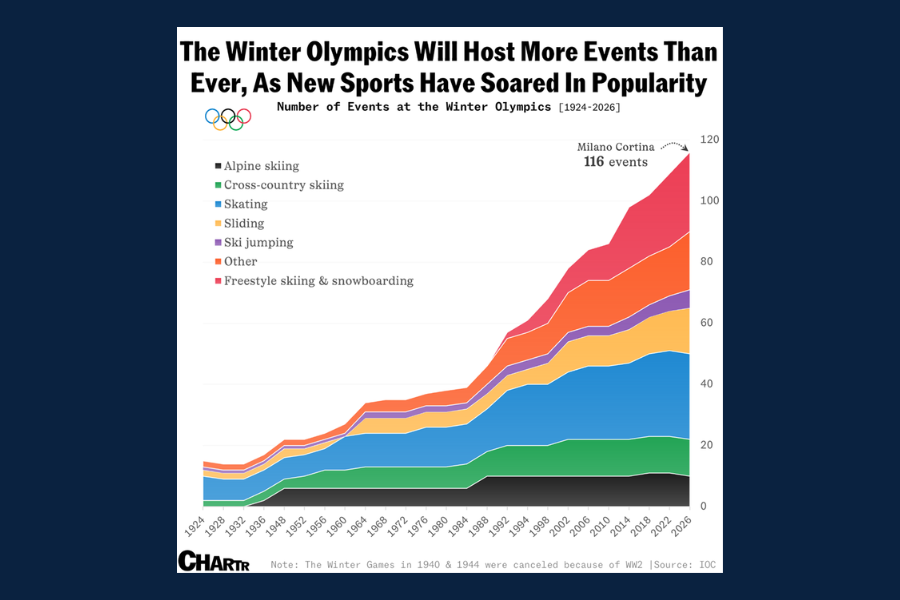

Following the conclusion of the 2026 Winter Olympics, today’s Chart of the Day comes from Chartr, highlighting the expansion of the Winter Games..

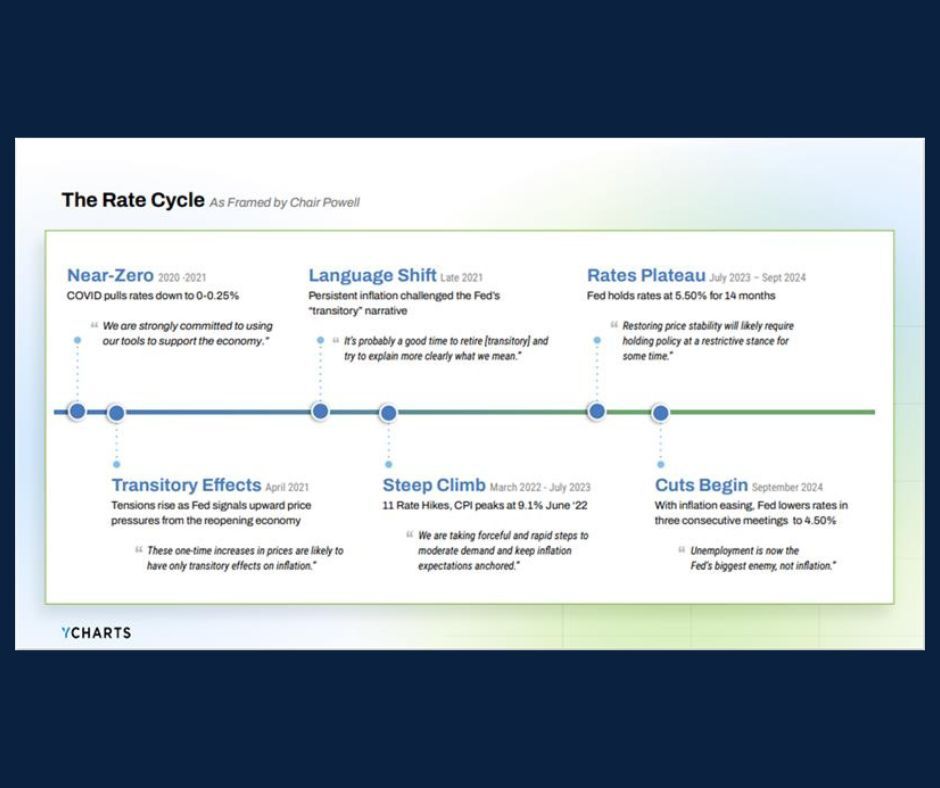

With the current Federal Reserve Chair’s term set to conclude this May, today's Chart of the Day from YCharts looks back at the interest‑rate cycle..

When most people hear the term estate planning, they picture retirees, their parents, or individuals with significant wealth. But the truth is that..

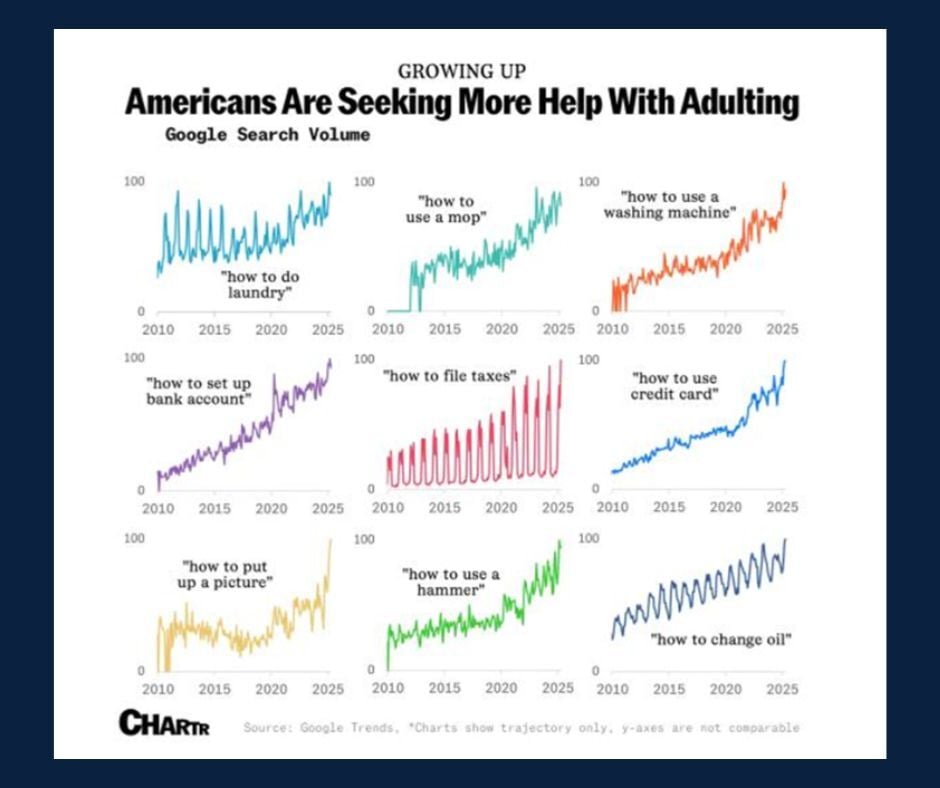

Today's Chart of the Day from Chartr shows a steady rise in Google searches for basic “adulting” tasks—from doing laundry and using a mop to filing..

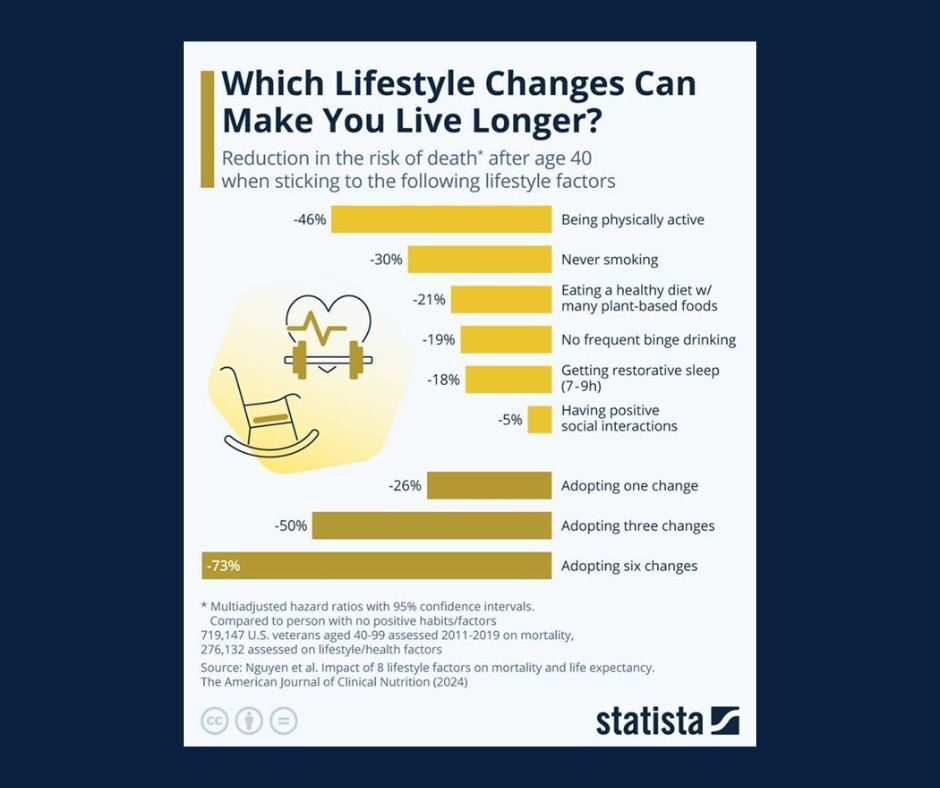

Today's Chart of the Day from Statista highlights how everyday habits can meaningfully influence longevity, especially after age 40.

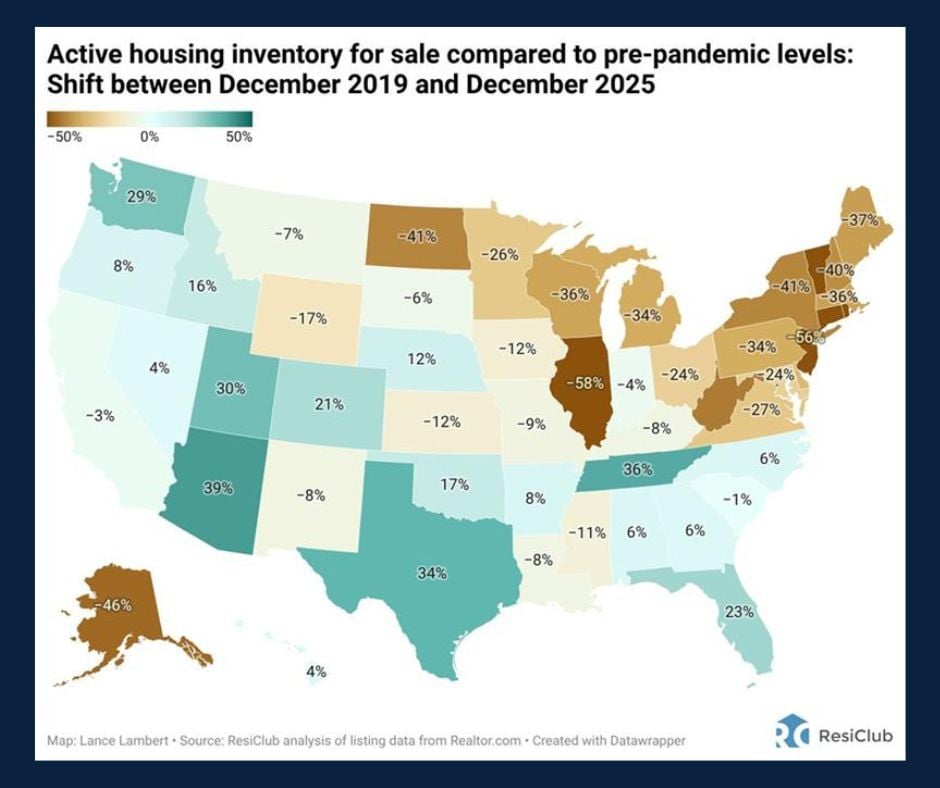

Today's Chart of the day from ResiClub illustrates how today’s housing inventory compares with pre‑covid levels.

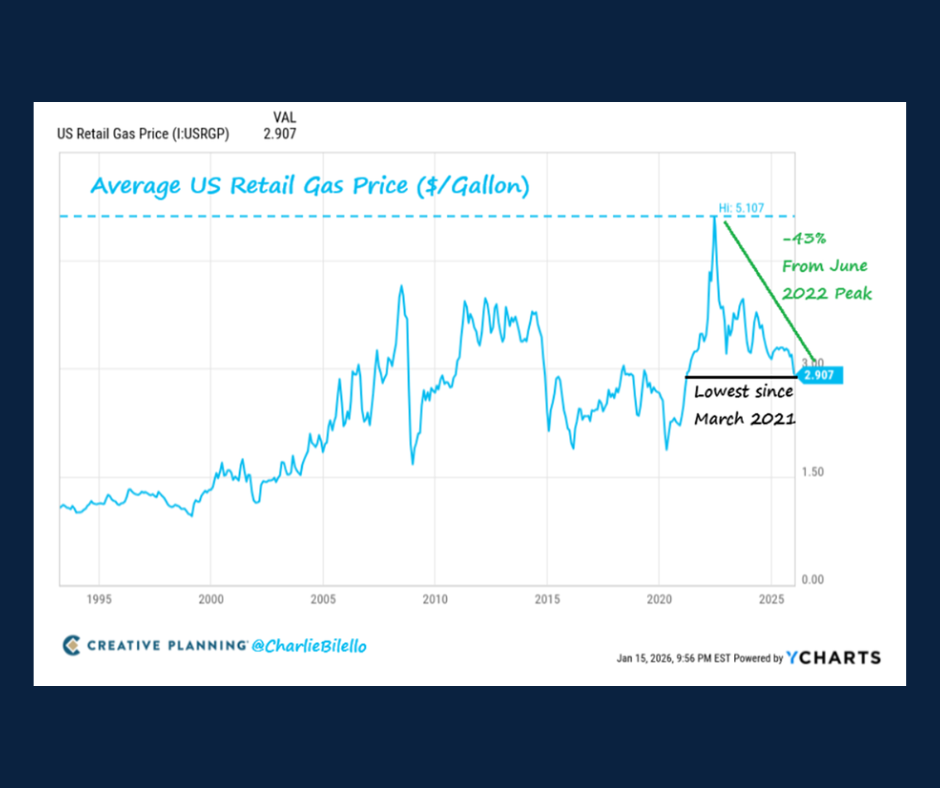

Today’s Chart of the Day from @CharlieBilello shows the trend of US retail gas prices. Down 43% from the 2022 peak, prices are falling close to a..

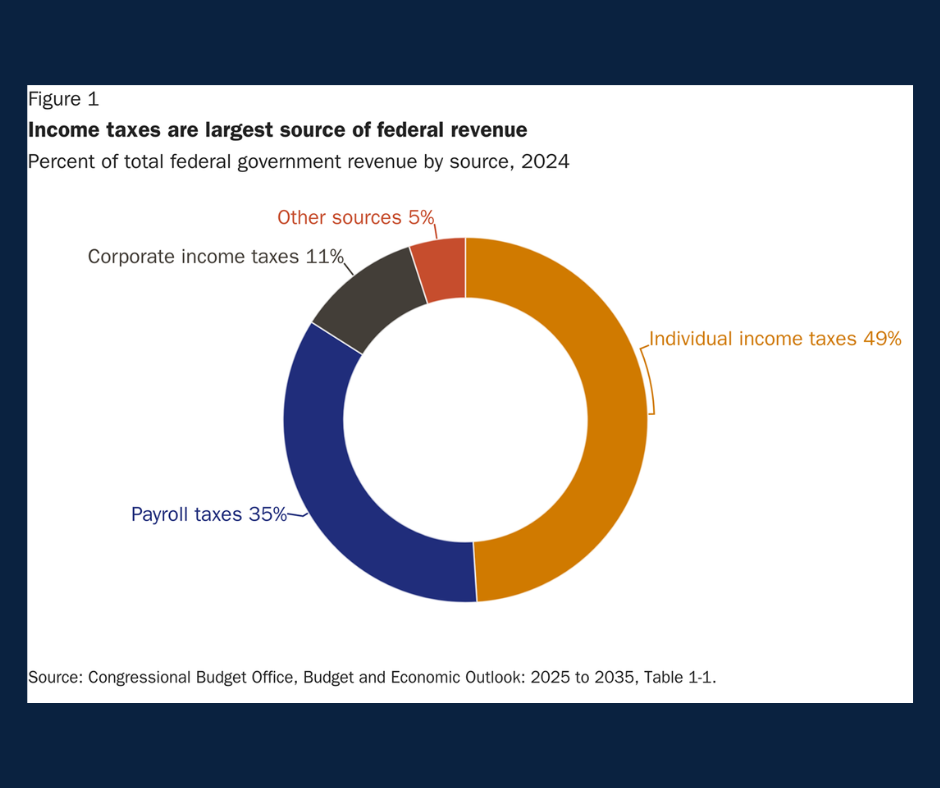

With tax season officially upon us, today's Chart of the Day from Liberty Taxed gives us an idea of the projected federal tax revenue over the coming..

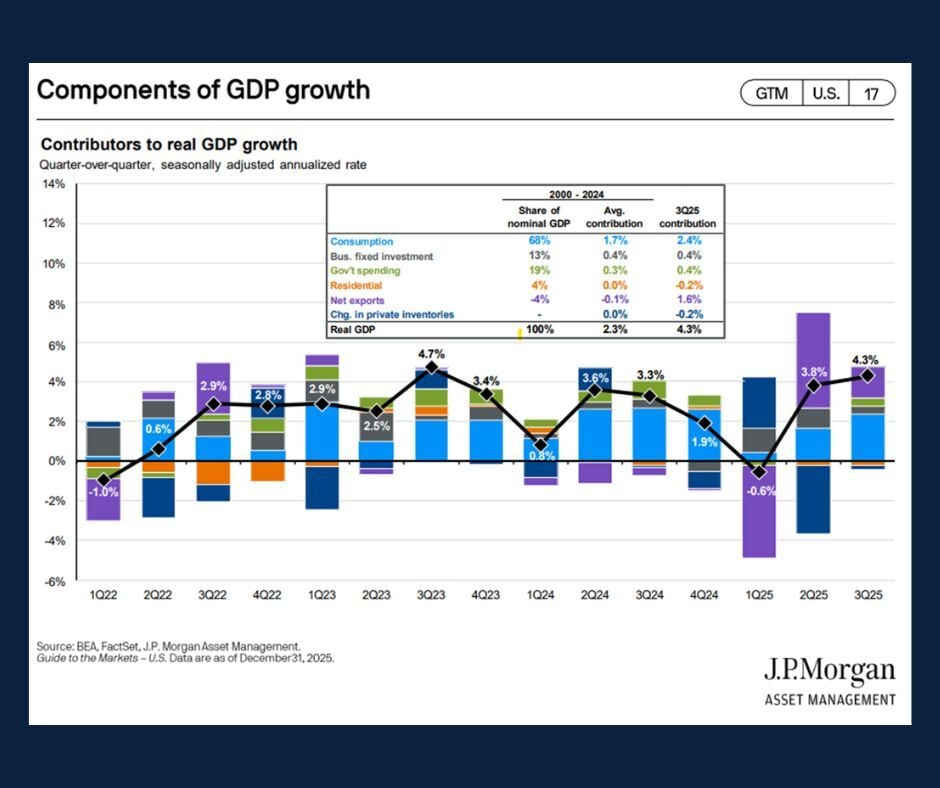

Today’s Chart of the Day comes from JP Morgan Asset Management and highlights the key components of GDP growth.

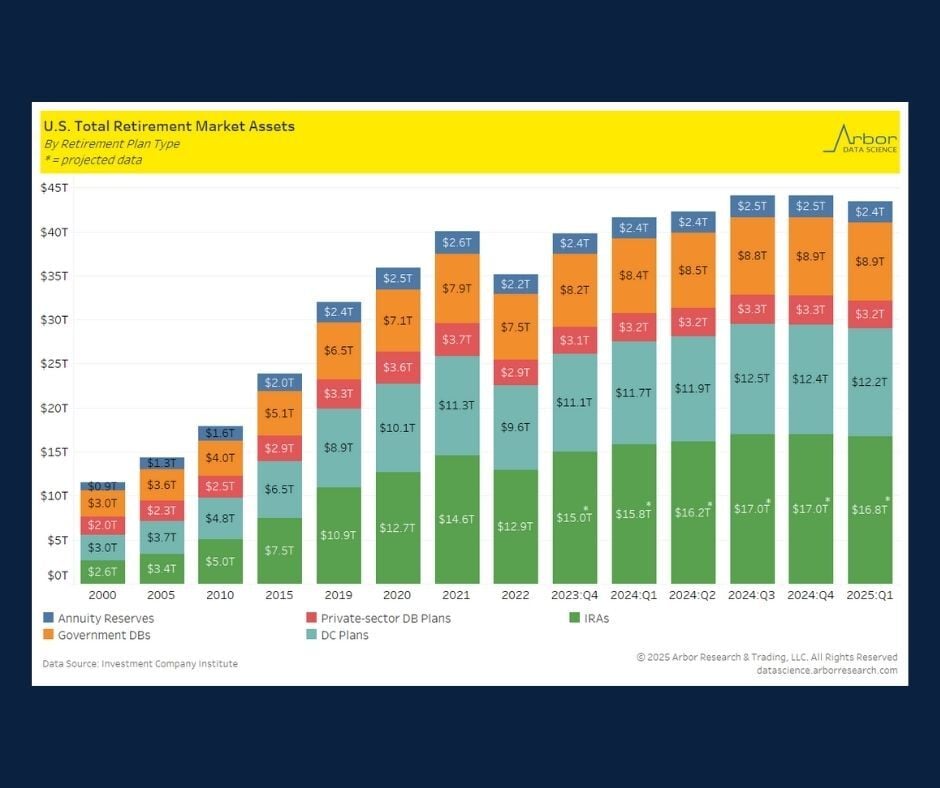

Today's Chart of the Day, from Arbor Data Science using data from Investment Company Institute, shows the value of the assets that make up the..

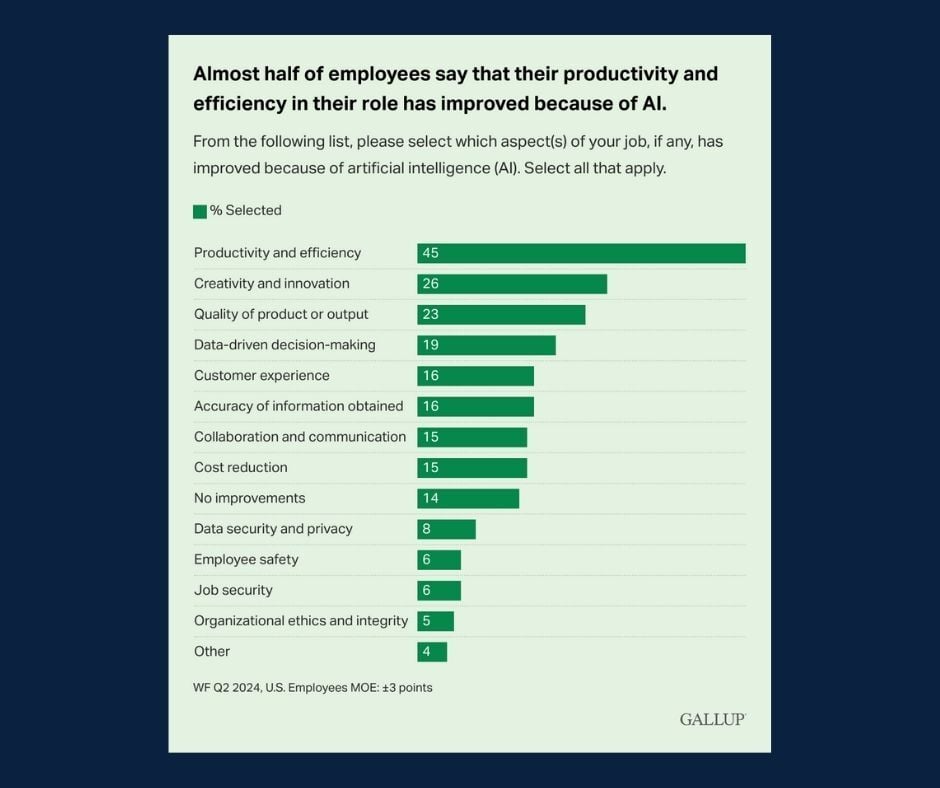

Today's Chart of the Day comes from a Gallup poll and shows the positive impact of AI in the workplace.

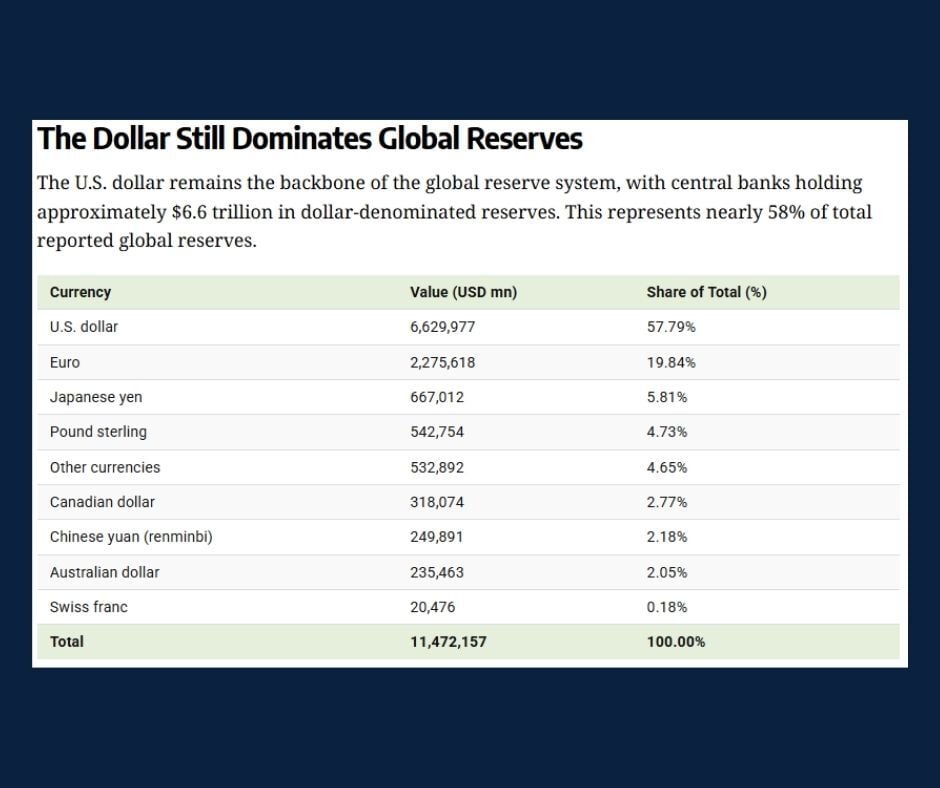

Today's Chart of the Day, from YCharts, highlights the market share of the US dollar.

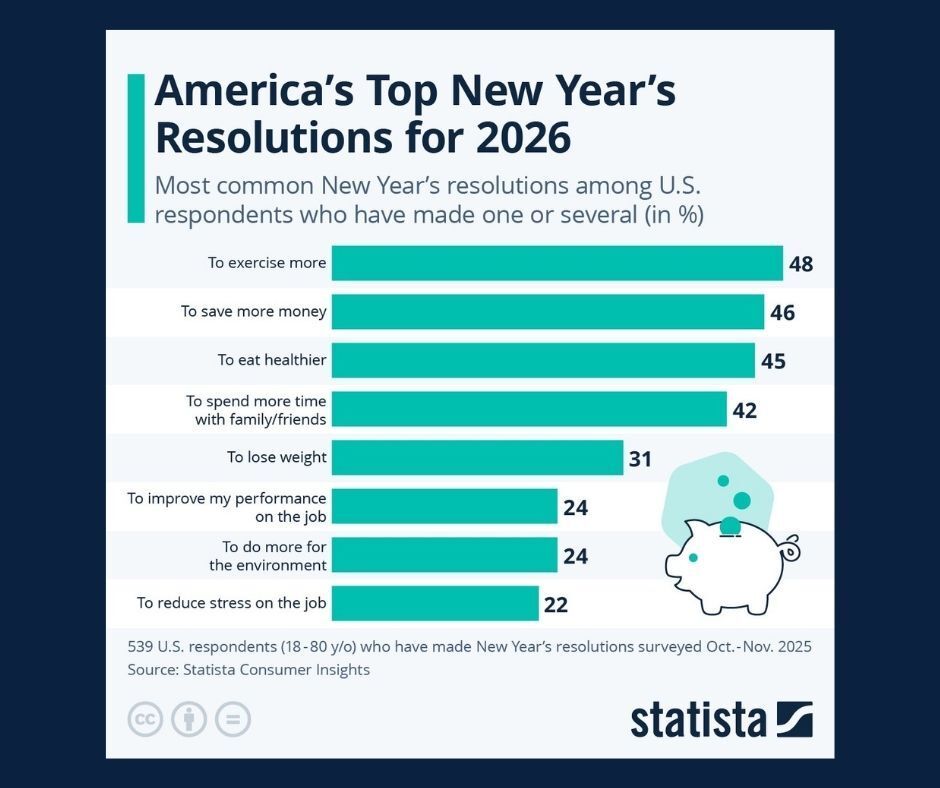

This chart comes from Statista and displays New Year’s resolution data for 2026.

Contrary to popular belief, estate planning isn’t just for the wealthy—it’s for anyone who wants to protect their loved ones and ensure their wishes..

Today’s Chart of the Day, shared by Charlie Bilello, highlights year‑end price targets for the S&P 500 as forecasted by major Wall Street banks.

Following the conclusion of the 2026 Winter Olympics, today’s Chart of the Day comes from Chartr, highlighting the expansion of the Winter Games events dating back to 1924.

With the current Federal Reserve Chair’s term set to conclude this May, today's Chart of the Day from YCharts looks back at the interest‑rate cycle during his tenure.

When most people hear the term estate planning, they picture retirees, their parents, or individuals with significant wealth. But the truth is that estate planning isn’t just for your parents, grandparents, or the wealthy; it’s important for young adults, too. Whether you're just starting your career, beginning a family, traveling frequently, managing digital accounts, or building savings, having a plan protects you, your loved ones, and your assets.

Today's Chart of the Day from Chartr shows a steady rise in Google searches for basic “adulting” tasks—from doing laundry and using a mop to filing taxes and setting up a bank account.

Today's Chart of the day from ResiClub illustrates how today’s housing inventory compares with pre‑covid levels.

Today’s Chart of the Day from @CharlieBilello shows the trend of US retail gas prices. Down 43% from the 2022 peak, prices are falling close to a 5-year low.

With tax season officially upon us, today's Chart of the Day from Liberty Taxed gives us an idea of the projected federal tax revenue over the coming years.

Today’s Chart of the Day comes from JP Morgan Asset Management and highlights the key components of GDP growth.

Contrary to popular belief, estate planning isn’t just for the wealthy—it’s for anyone who wants to protect their loved ones and ensure their wishes are honored. Without an estate plan, you leave critical decisions in the hands of the state and/or someone you may not have chosen, and the consequences can be far from what you intended.

current_page_num+2: 3 -