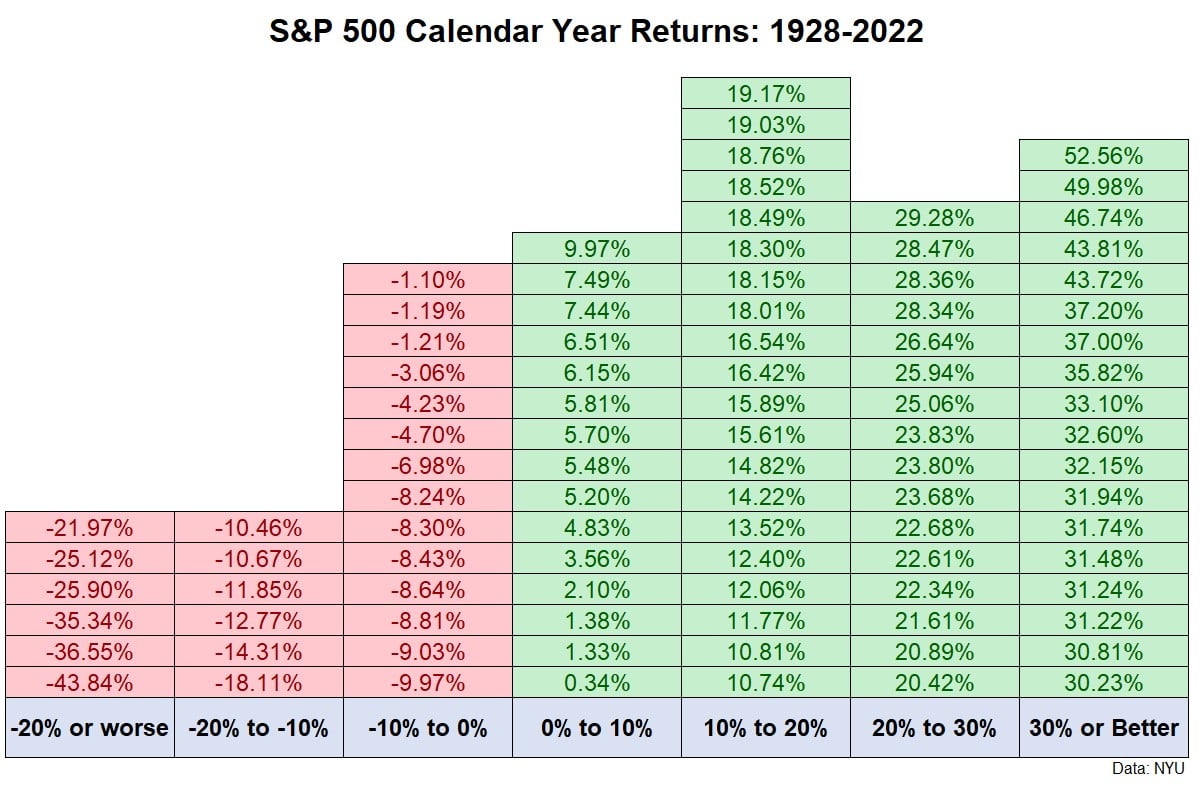

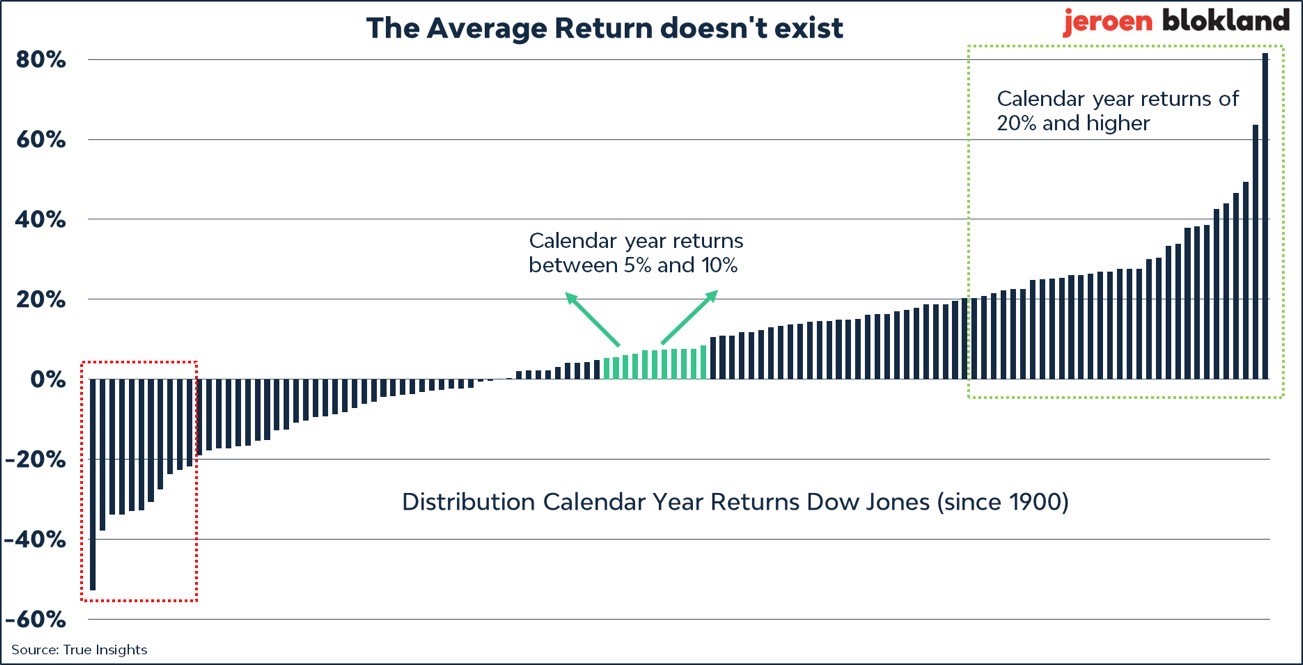

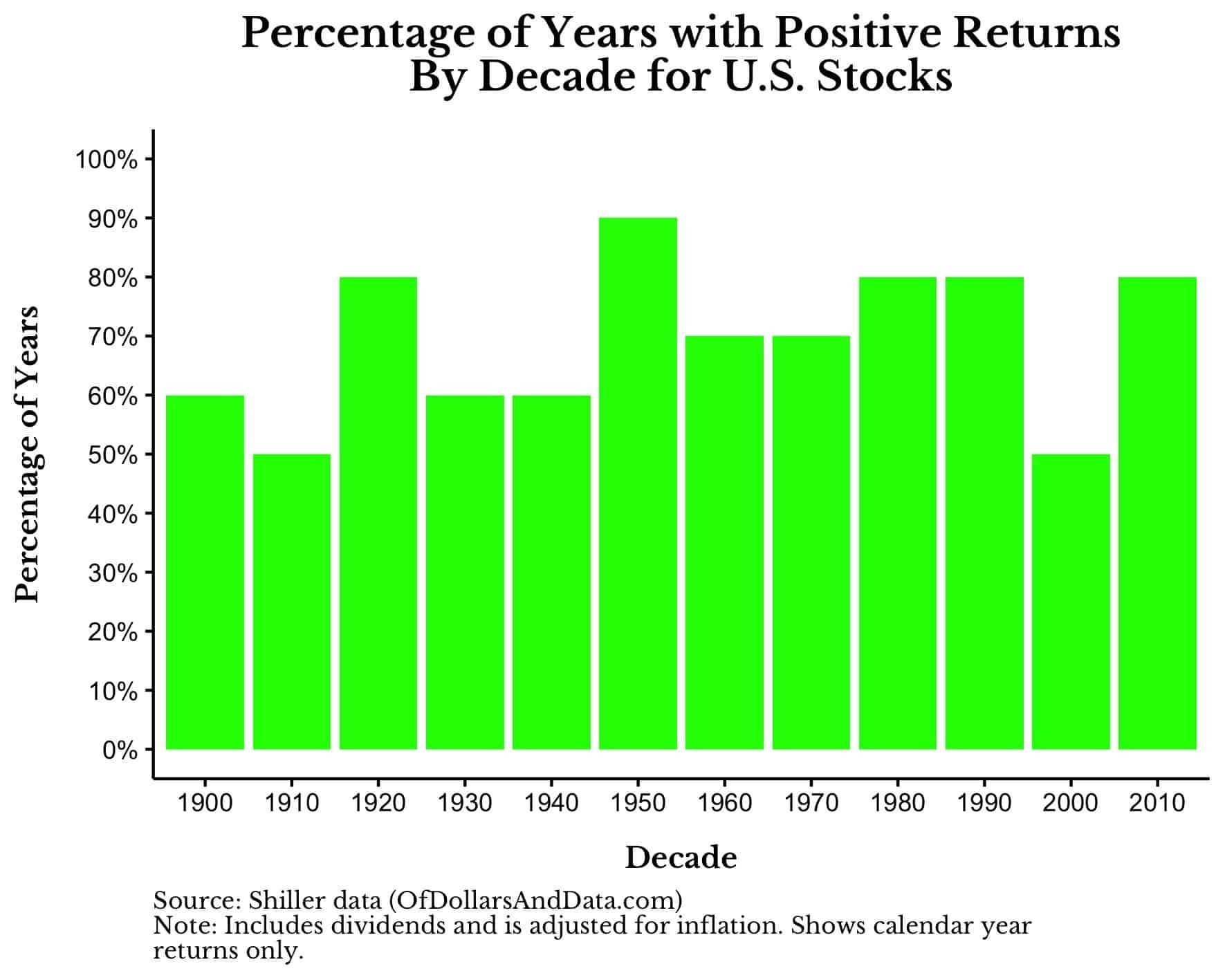

Chart of the Day: Every 2.5 Years

Today's Chart of the Day comes from A Wealth of Common Sense and shows the annual returns of the stock market since 1928. There were 69 positive years versus 26 negative years. This results in a negative year on average of every 2.5 years. For the last few years, we’ve become used to a string of consecutive positive ones, which has made it tough to remember that negative ones are a normal course of business.