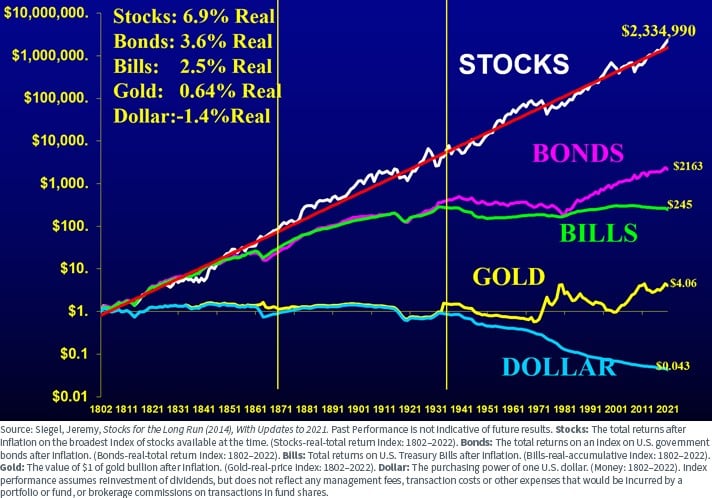

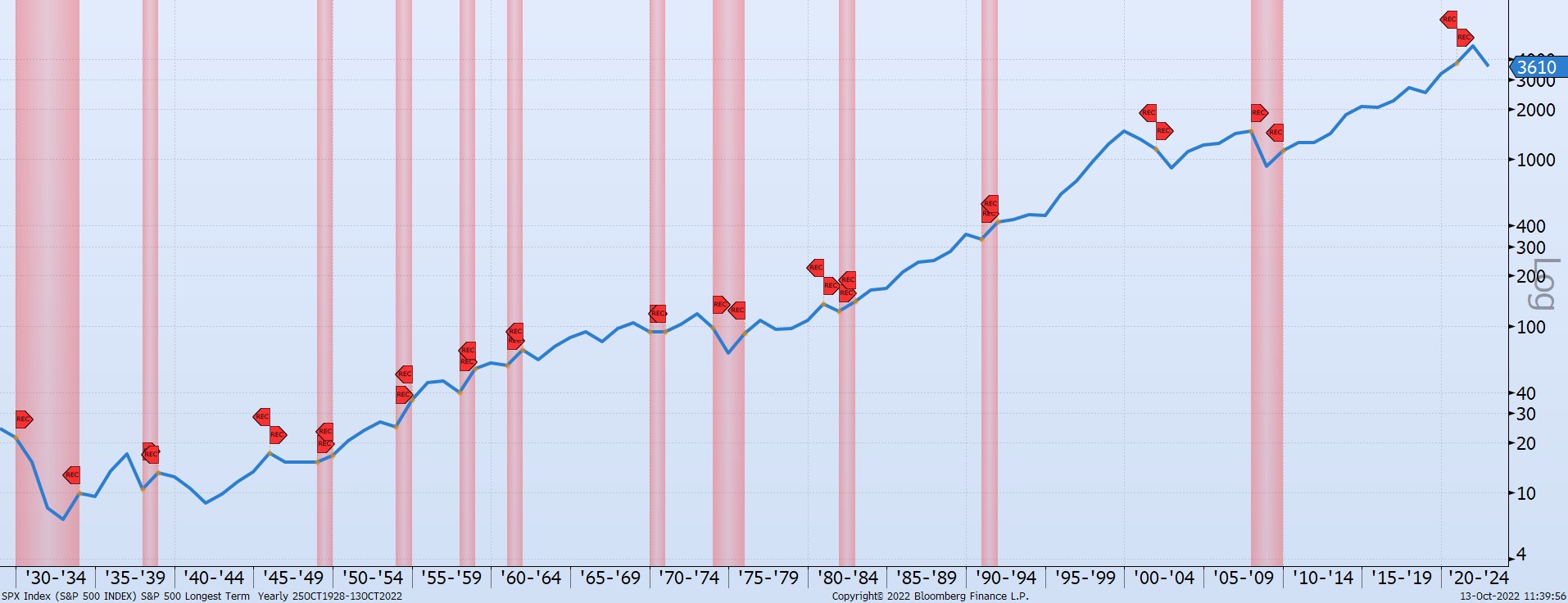

Stocks for The Long Run

This chart shows the value of $1 going all the way back to 1802 and was previously shared as a Chart of the Day. However, I'd like to share it once again as the figures were updated to include data from 2021. The chart was created by Jeremy Seigel in his book called “Stocks for the Long Run” published in 2014.