- Financial Resources

- Blog

Blog

Your Weekly

Financial Forecast

Stay informed with sound financial know-how

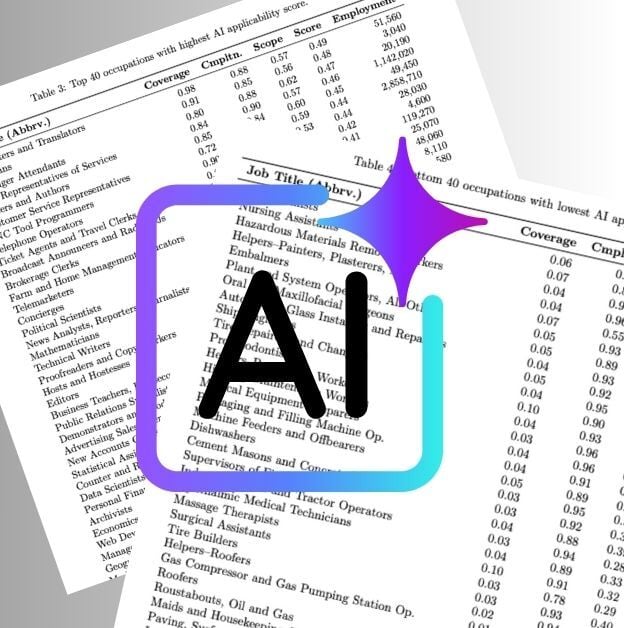

Chart of the Day: AI and Compatible Jobs

Today’s Chart of the Day is from a study by Cornell University (arXiv.org) published in July 2025, called “Working with AI: Measuring the..

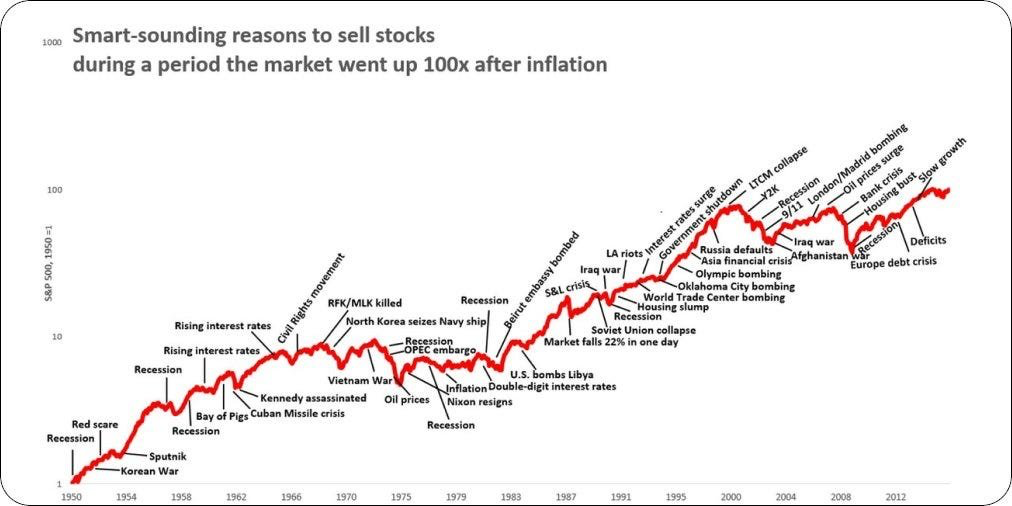

Chart of the Day: Reasons to Sell

Today’s Chart is from @QCompounding showing 50+ "smart-sounding" reasons used to sell stocks since 1950 to 2020, all while the market went up 100(x)..

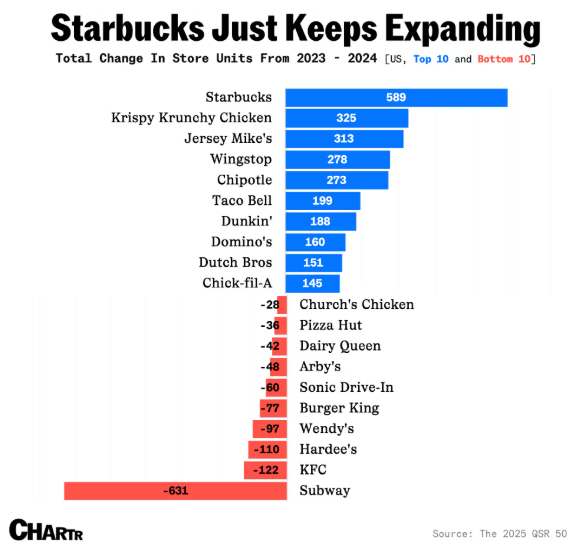

Chart of the Day: Starbucks for the Win

Today’s Chart of the Day is from Chartr and confirms you are not imaging things while driving around. Yes, you are seeing more and more Starbucks pop..

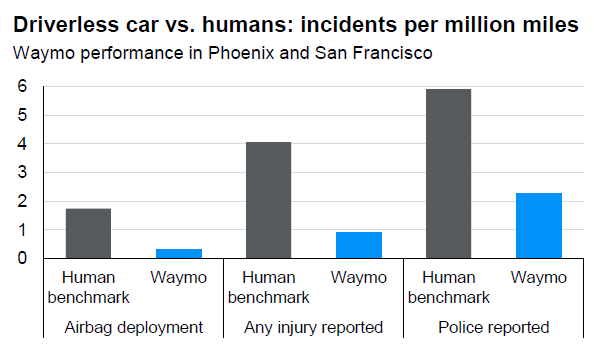

Chart of the Day: Driver vs. Driverless Cars

Today’s Chart of the Day is from a Waymo*/Stanford report shared by JP Morgan that shows the “incidents per million miles" comparing human drivers,..

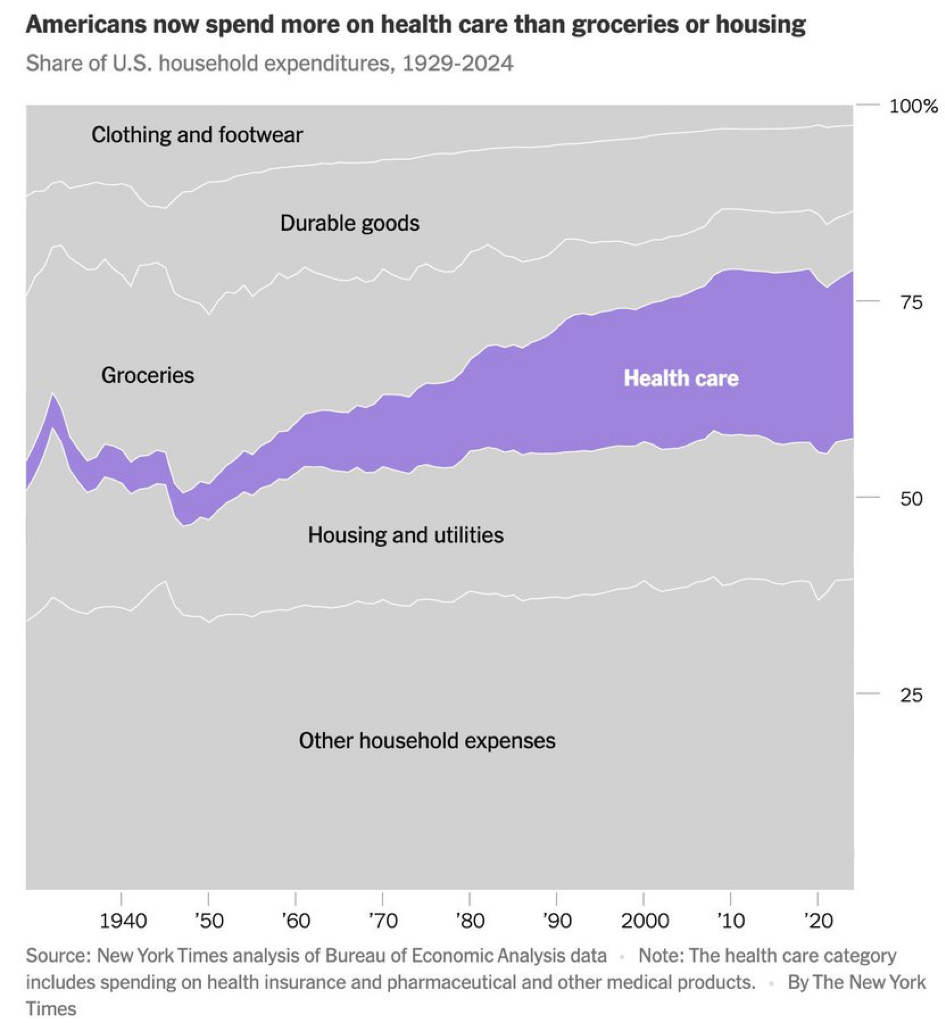

Chart of the Day: Percent Spent on Healthcare

Today’s Chart of the Day from The New York Times shows the share of US household expenditures in various consumer categories, such as groceries,..

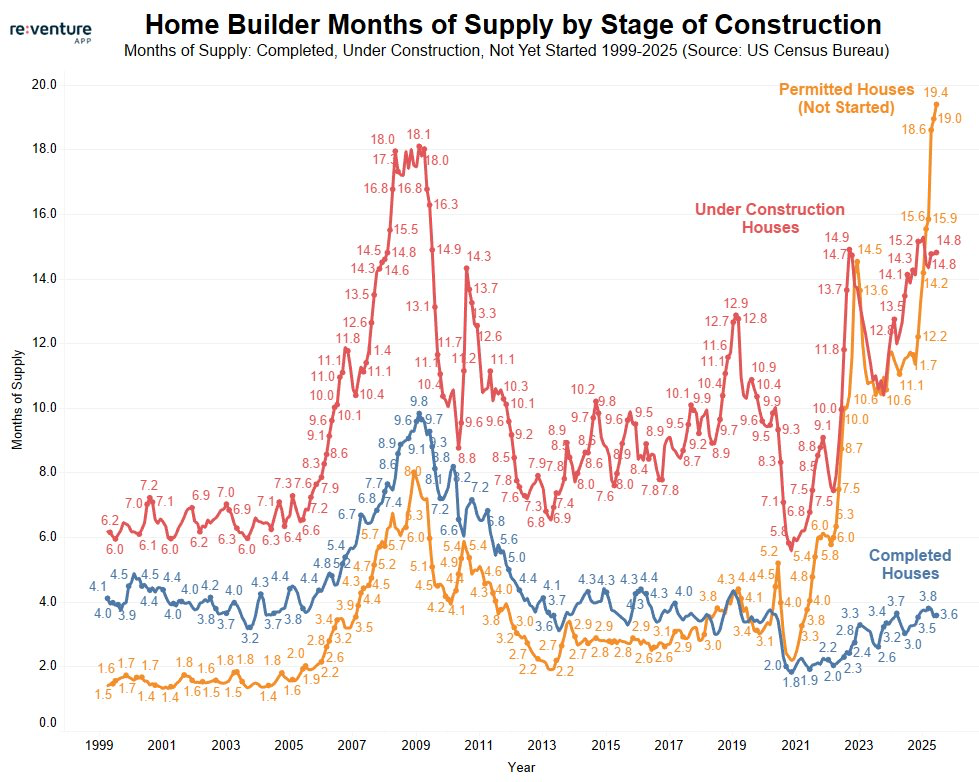

Chart of the Day: Permitted House Explosion

Today’s Chart of the Day is from re:venture and shows the history of home builder months of supply by stage of construction.

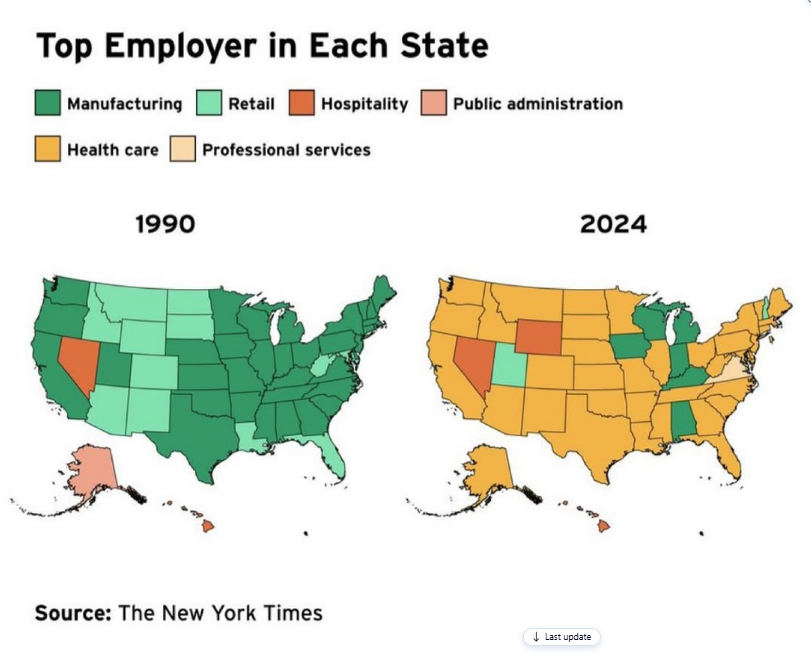

Chart of the Day: Top Employers

Today’s Chart of the Day, shared by my colleague Jackson Garner, is from an article in The New York Times showing the change in the top employer (by..

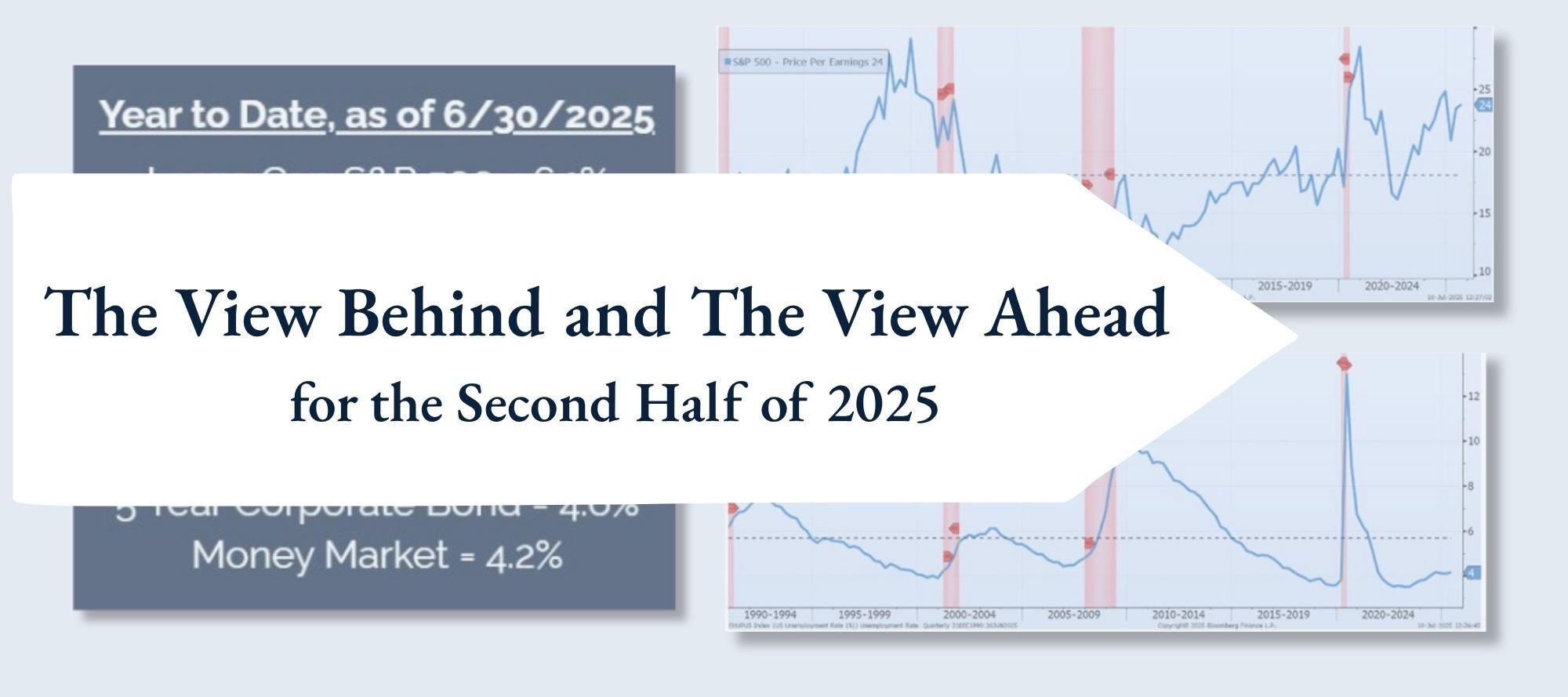

Chart of the Day Extra: The Year-to-Date Recap

As we closed out the first half of 2025, all I could think is, “That was a wild ride!”

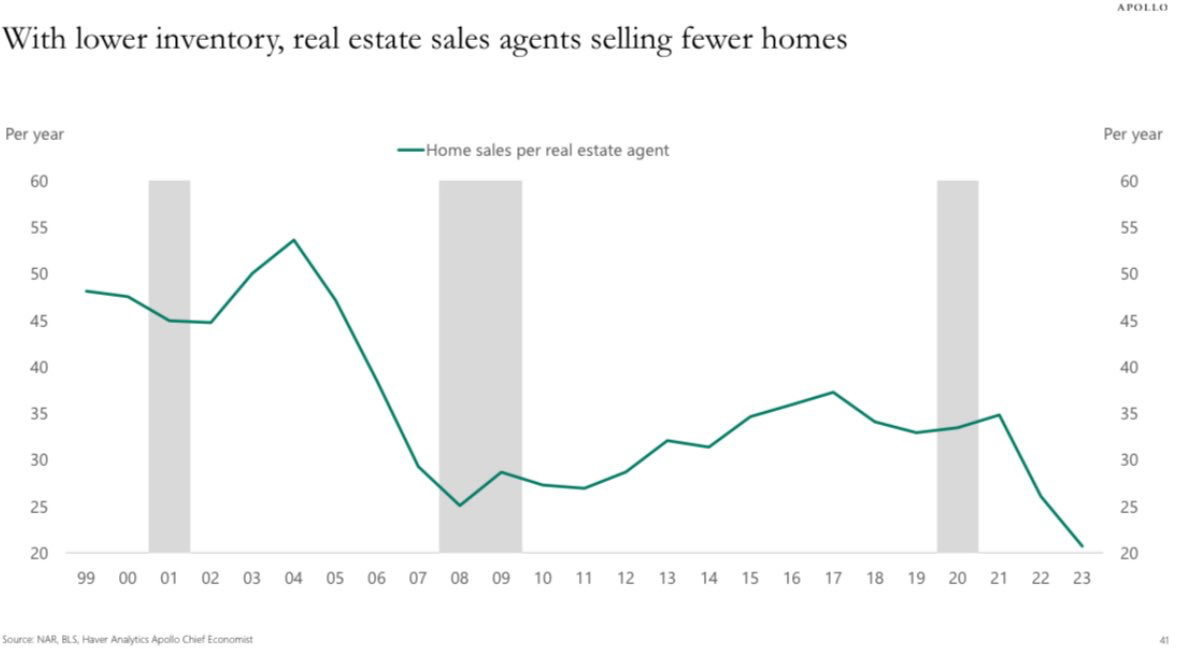

Chart of the Day: Number of Homes Sold Per Agent

Today’s Chart of the Day is from Torsten Slok of Apollo Global Management's US Housing Outlook report, showing home sales per real estate agent since..

Chart of the Day Extra: Complimentary Estate-Planning Seminars 7/29-31

Join Christine Hause, Vice President and Senior Wealth Strategist, and me, Chart of the Day author Samuel A. Kiburz, Senior Vice President, Chief..

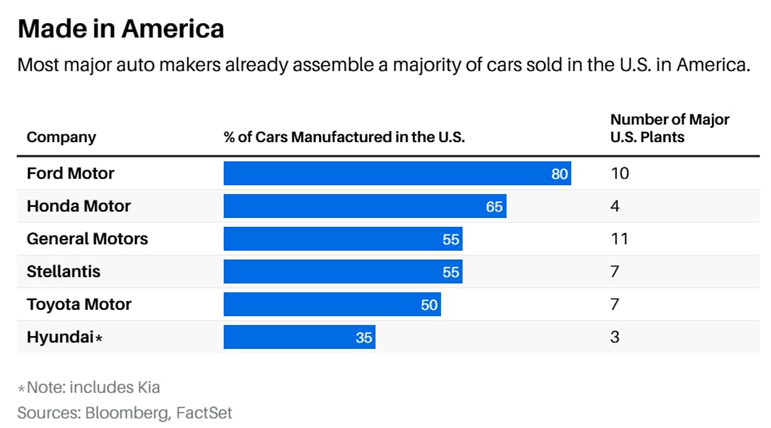

Chart of the Day: % of Their Car

Today’s Chart of the Day, from Barron’s with data from Bloomberg, shows what percentage of a car is assembled in the US by manufacturer and the..

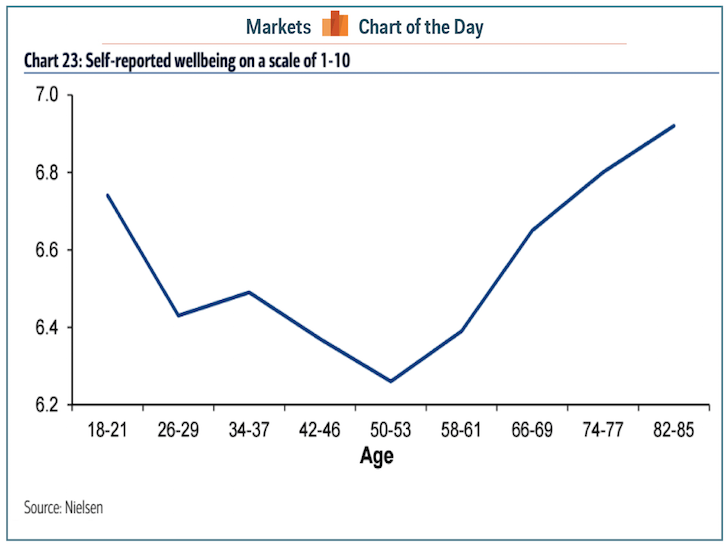

Chart of the Day: Age 52 Then Happier

Today’s Chart of the Day, based on a Nielsen survey, shows the changes in the level of self-reported wellbeingon a scale from 1-10, by age.

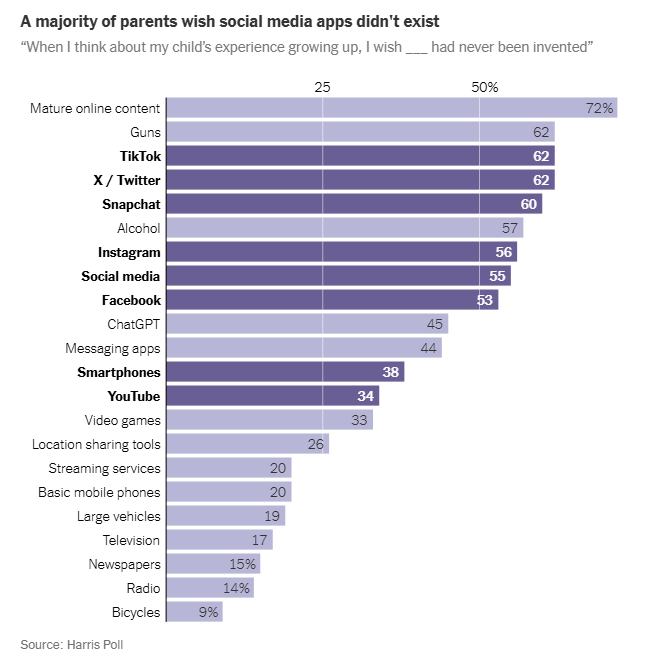

Chart of the Day: Wish This Was Not Around

Today’s Chart of the Day, “We Don’t Have to Give in to the Smartphones,” is from a New York Times article.

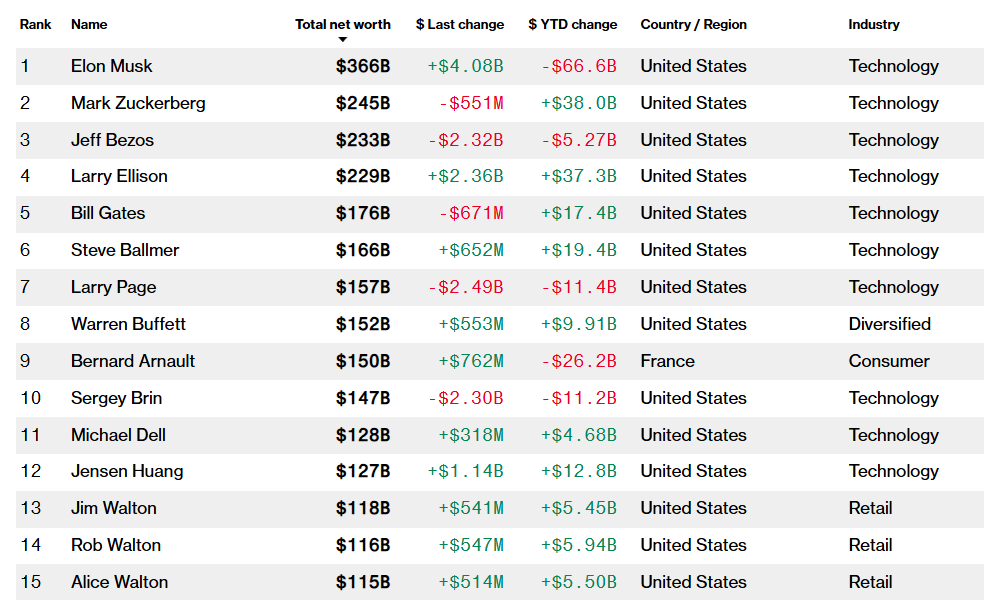

Chart of the Day: Top 15 Individuals

Today’s Chart of the Day is from Bloomberg’s Billionaires Index, listing the 15 wealthiest individuals on the planet.

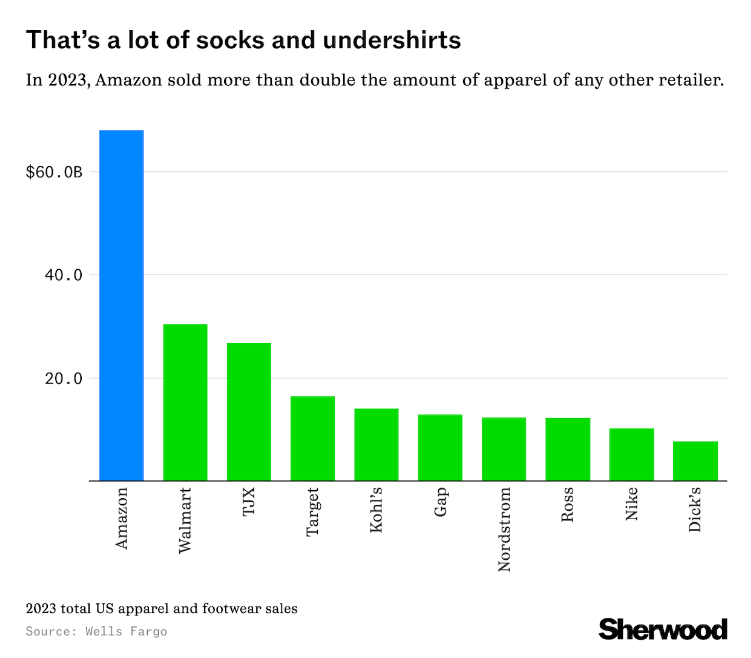

Chart of the Day: Amazon Clothes for the Win

Today’s Chart of the Day, from Wells Fargo in an article by Sherwood, is something to ponder the next time you’re at the mall - if you still go.

On Our Minds

Chart of the Day: Reasons to Sell

Chart of the Day: Starbucks for the Win

Today’s Chart of the Day is from Chartr and confirms you are not imaging things while driving around. Yes, you are seeing more and more Starbucks pop up as they keep expanding, opening 589 stores in 2024!

Chart of the Day: Driver vs. Driverless Cars

Today’s Chart of the Day is from a Waymo*/Stanford report shared by JP Morgan that shows the “incidents per million miles" comparing human drivers, in the gray bars, to driverless Waymo autos represented in the blue bars.

Chart of the Day: Percent Spent on Healthcare

Today’s Chart of the Day from The New York Times shows the share of US household expenditures in various consumer categories, such as groceries, clothing, housing, and healthcare.

Chart of the Day: Permitted House Explosion

Today’s Chart of the Day is from re:venture and shows the history of home builder months of supply by stage of construction.

Chart of the Day: Top Employers

Today’s Chart of the Day, shared by my colleague Jackson Garner, is from an article in The New York Times showing the change in the top employer (by industry) in each state from 1990 to 2024.

Chart of the Day Extra: The Year-to-Date Recap

As we closed out the first half of 2025, all I could think is, “That was a wild ride!”

Chart of the Day: Number of Homes Sold Per Agent

Chart of the Day Extra: Complimentary Estate-Planning Seminars 7/29-31

Join Christine Hause, Vice President and Senior Wealth Strategist, and me, Chart of the Day author Samuel A. Kiburz, Senior Vice President, Chief Investment Officer, for complimentary estate-planning seminars at our Punta Gorda branch, 2331 Tamiami Trail, next week.

Chart of the Day: % of Their Car

Today’s Chart of the Day, from Barron’s with data from Bloomberg, shows what percentage of a car is assembled in the US by manufacturer and the number of major US plants each company owns.

Chart of the Day: Age 52 Then Happier

Today’s Chart of the Day, based on a Nielsen survey, shows the changes in the level of self-reported wellbeingon a scale from 1-10, by age.

Chart of the Day: Wish This Was Not Around

Today’s Chart of the Day, “We Don’t Have to Give in to the Smartphones,” is from a New York Times article.

Chart of the Day: Top 15 Individuals

Today’s Chart of the Day is from Bloomberg’s Billionaires Index, listing the 15 wealthiest individuals on the planet.

Chart of the Day: Amazon Clothes for the Win

current_page_num+2: 6 -