- Financial Resources

- Blog

Blog

Your Weekly

Financial Forecast

Stay informed with sound financial know-how

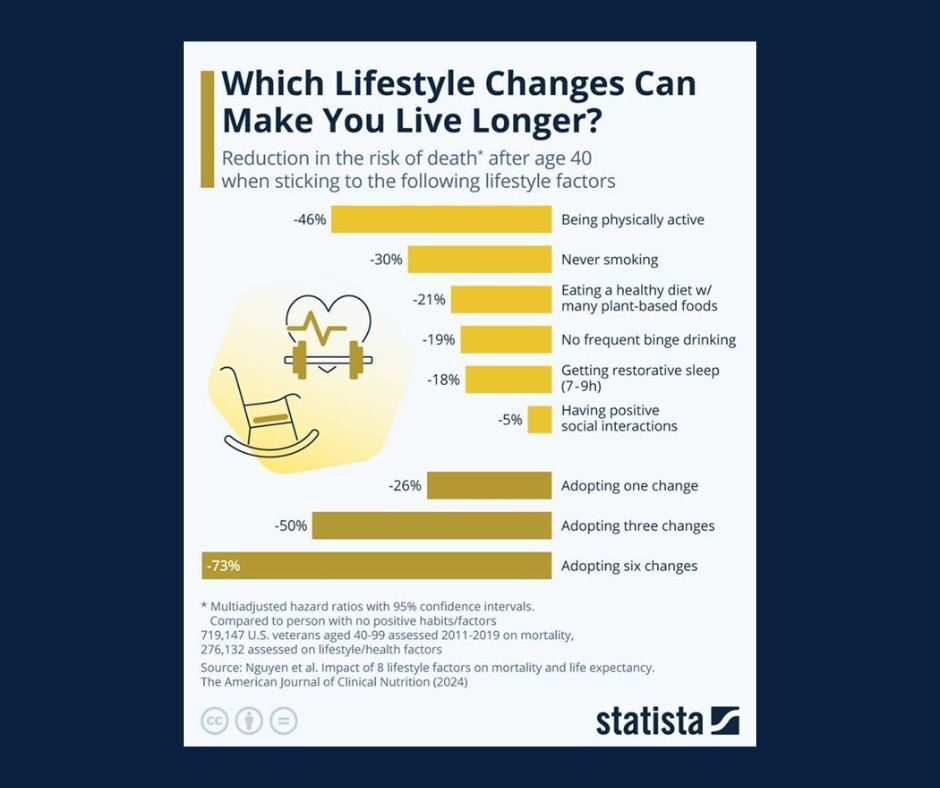

Chart of the Day: Lifestyle Changes for Longevity

Today's Chart of the Day from Statista highlights how everyday habits can meaningfully influence longevity, especially after age 40.

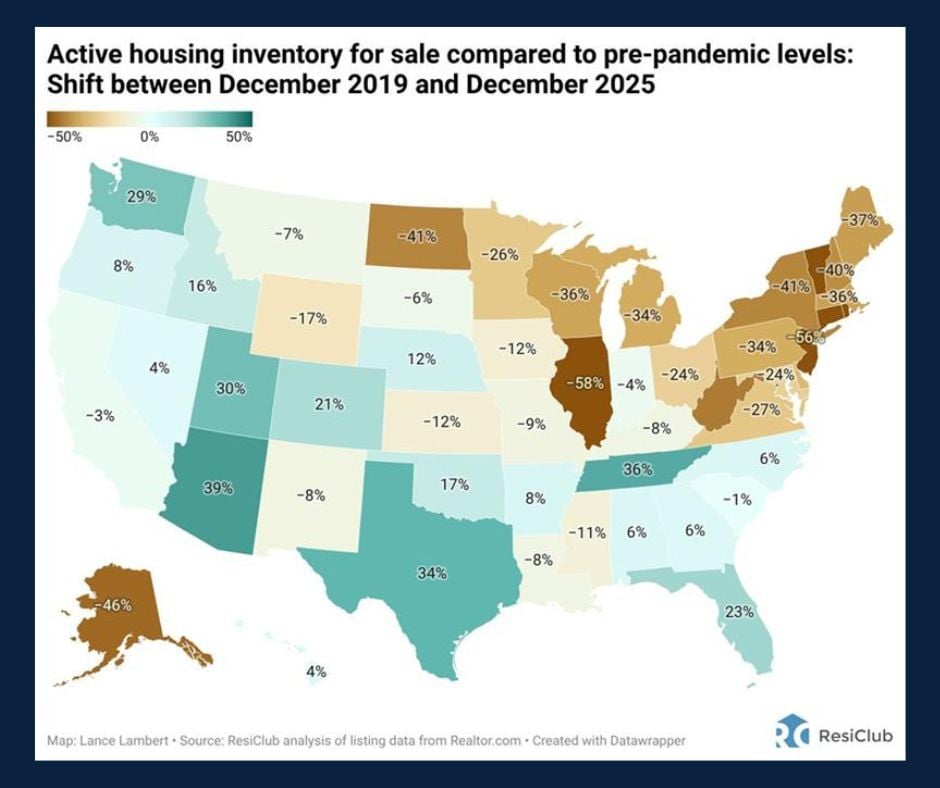

Chart of the Day: Housing Inventory

Today's Chart of the day from ResiClub illustrates how today’s housing inventory compares with pre‑covid levels.

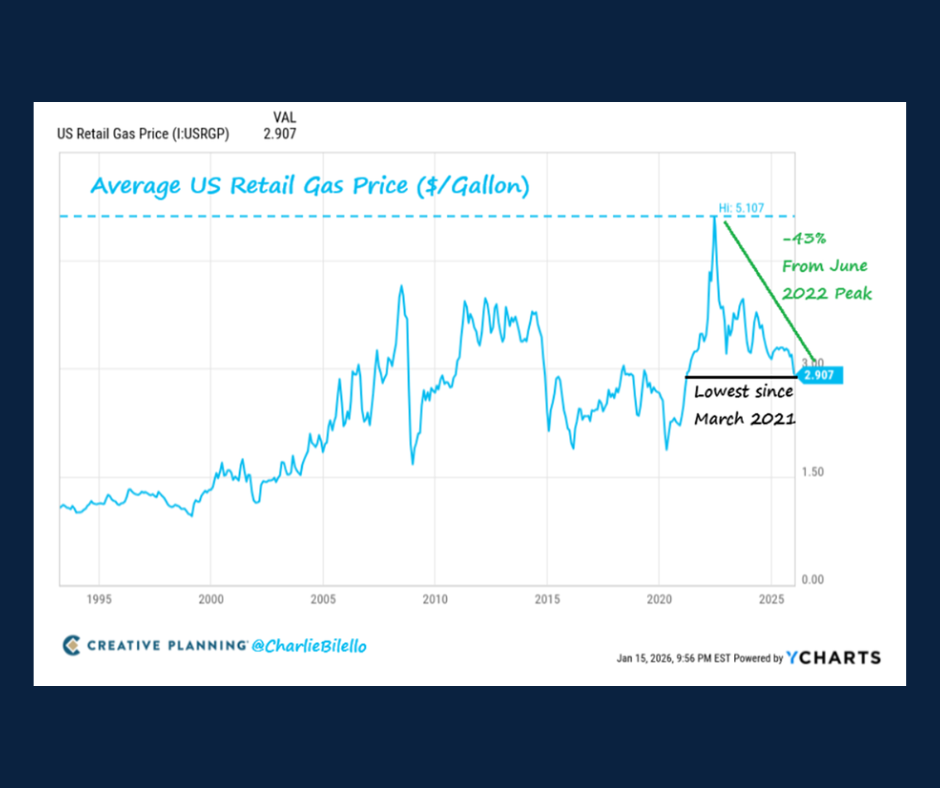

Chart of the Day: Average US Retail Gas Price

Today’s Chart of the Day from @CharlieBilello shows the trend of US retail gas prices. Down 43% from the 2022 peak, prices are falling close to a..

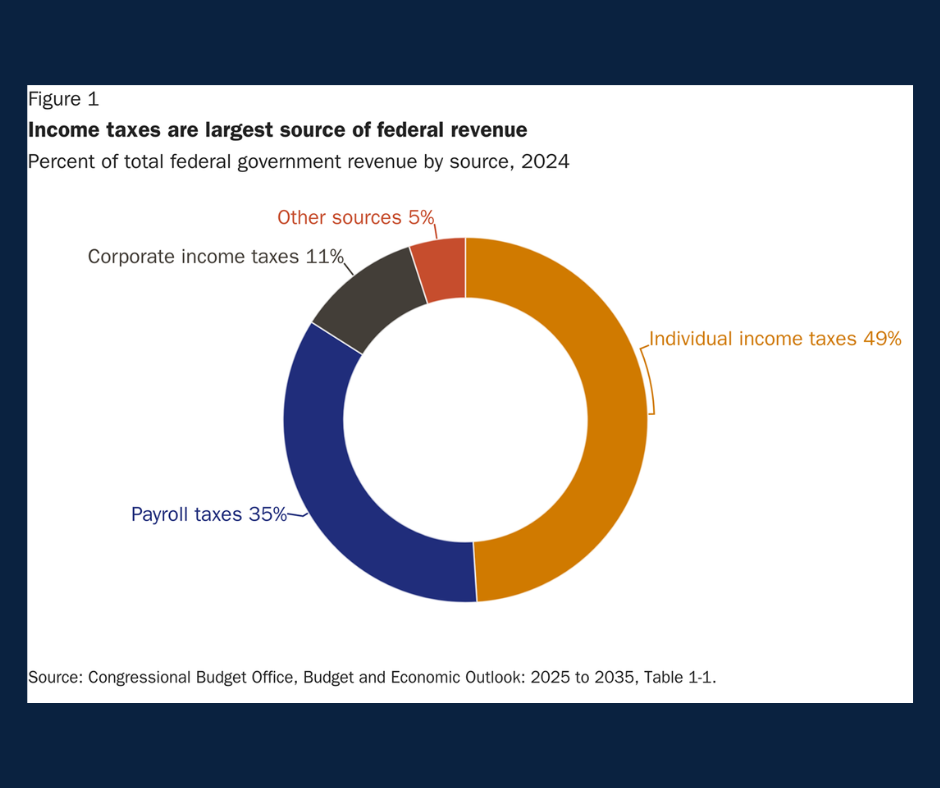

Chart of the Day: Largest Source of Federal Revenue

With tax season officially upon us, today's Chart of the Day from Liberty Taxed gives us an idea of the projected federal tax revenue over the coming..

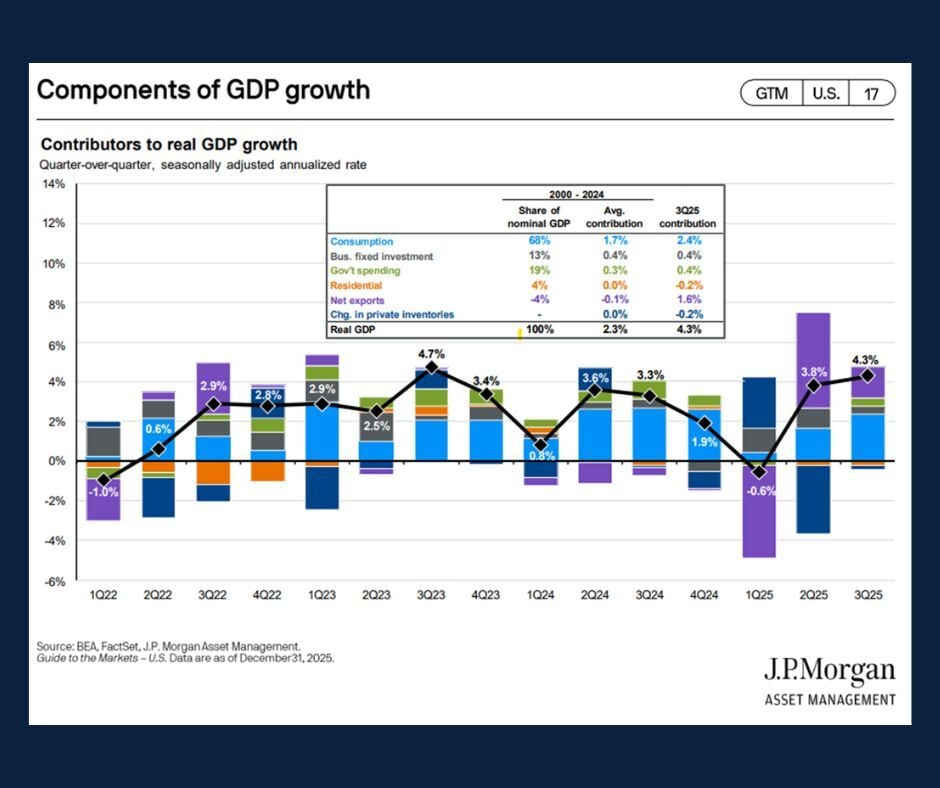

Chart of the Day: Components of GDP Growth

Today’s Chart of the Day comes from JP Morgan Asset Management and highlights the key components of GDP growth.

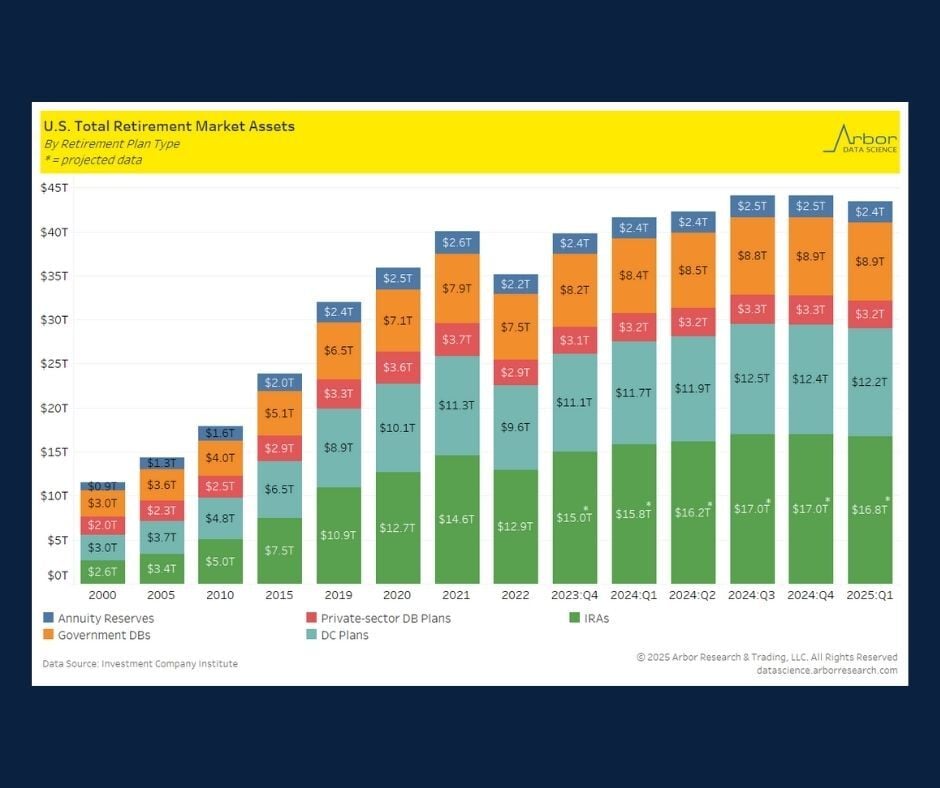

Chart of the Day: Value of Retirement Assets

Today's Chart of the Day, from Arbor Data Science using data from Investment Company Institute, shows the value of the assets that make up the..

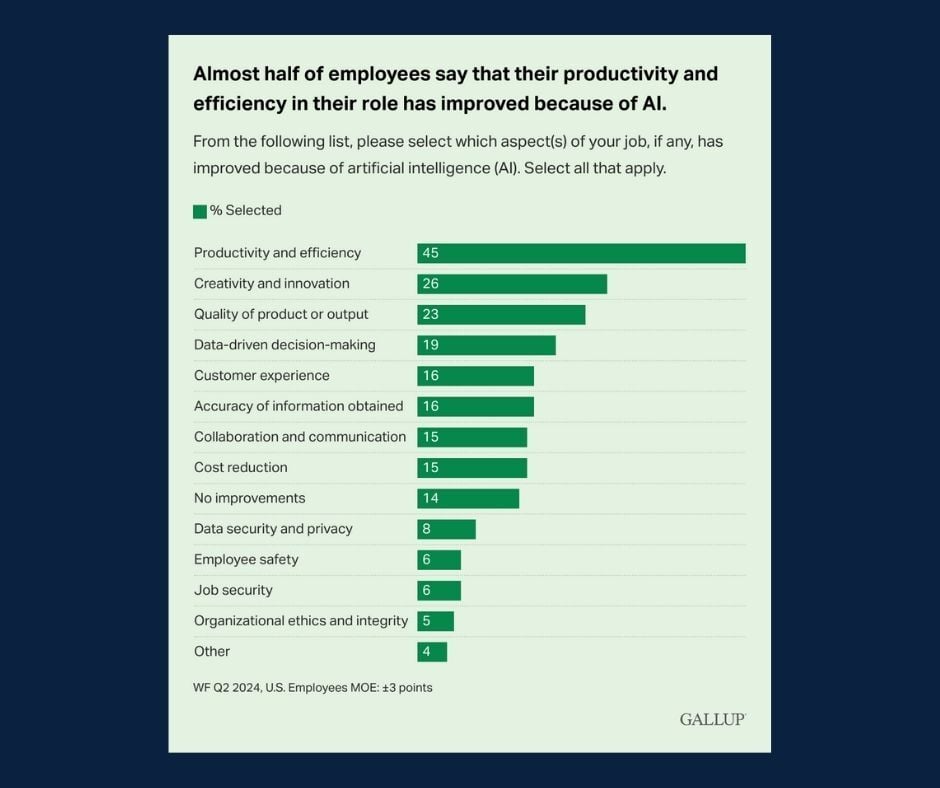

Chart of the Day: AI = Improved Productivity + Efficiency

Today's Chart of the Day comes from a Gallup poll and shows the positive impact of AI in the workplace.

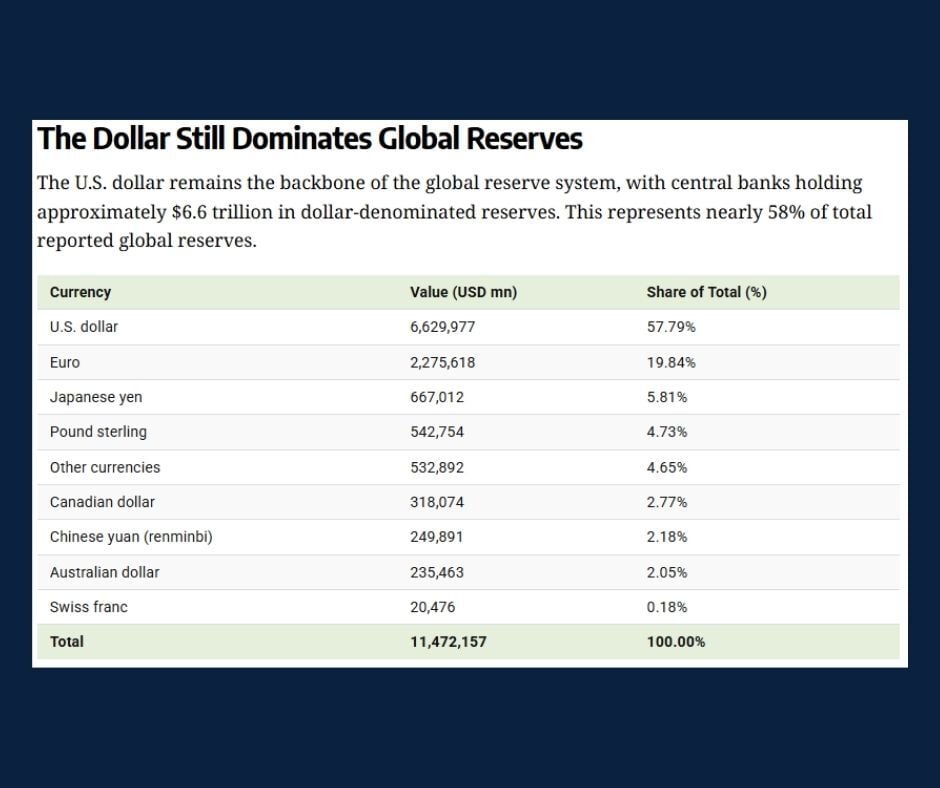

Chart of the Day: US Dollar Dominates

Today's Chart of the Day, from YCharts, highlights the market share of the US dollar.

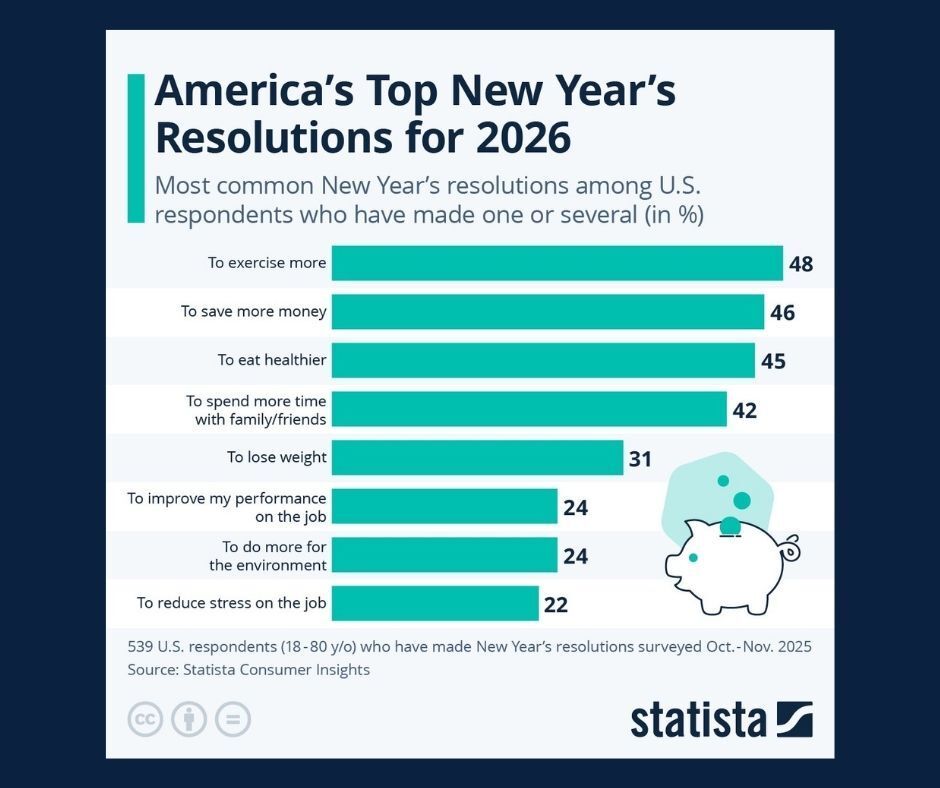

Chart of the Day: Top New Year's Resolutions

This chart comes from Statista and displays New Year’s resolution data for 2026.

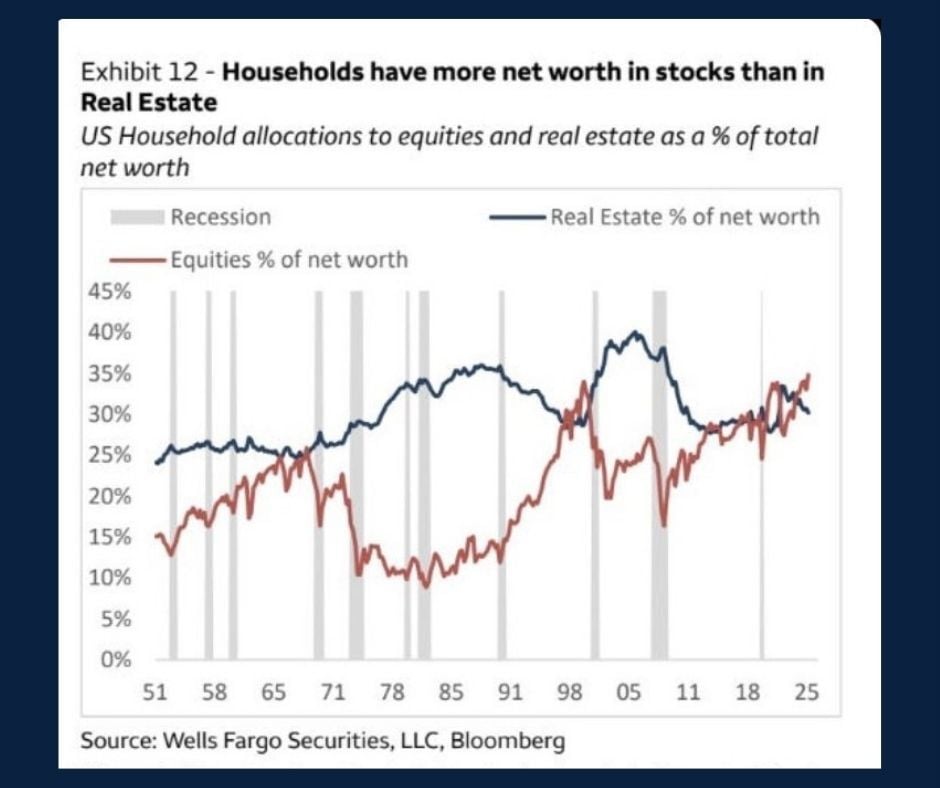

Chart of the Day: Net Worth in Stocks

Today's Chart of the Day, shared by dc_economics on Instagram, highlights a shift from historical trends related to household net worth.

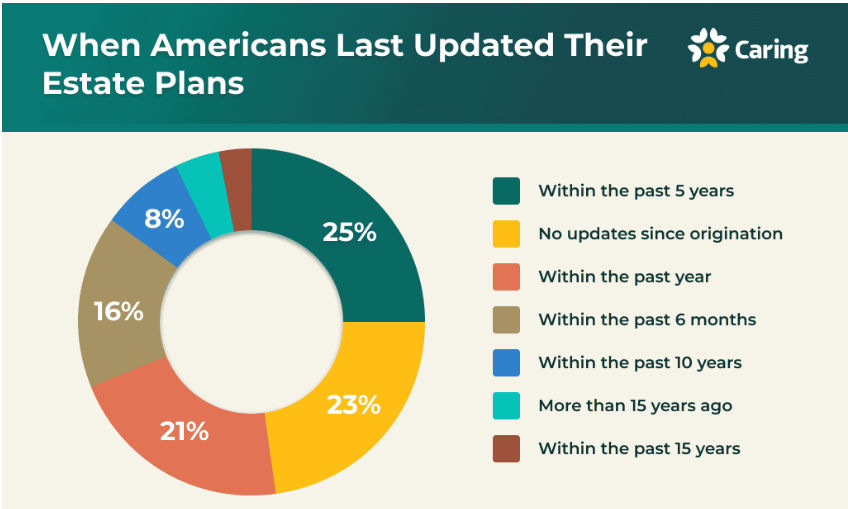

Chart of the Day: Estate Plan Updates - When and Why

Today’s Chart of the Day, prepared by Victoria Lurie at Caring.com, highlights findings from the 2025 Wills and Estate Planning Study.

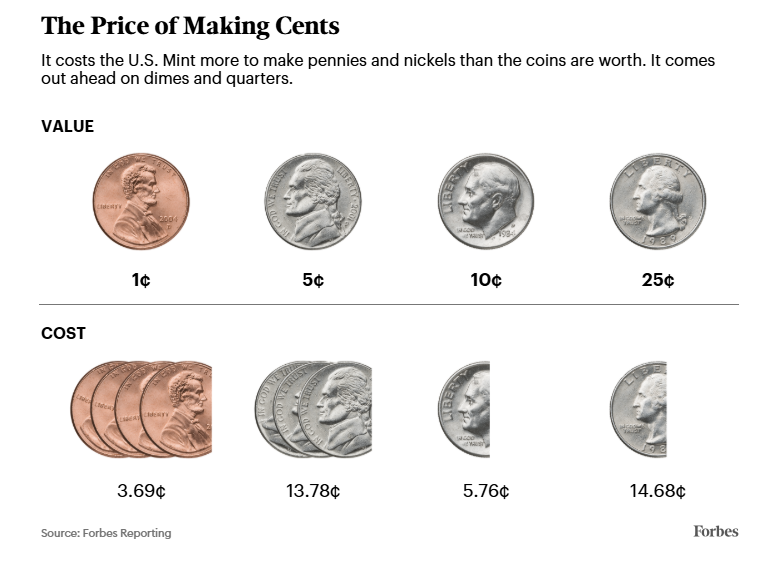

Chart of the Day: Does it Make Cents?

Today’s Chart of the Day comes from Kelly Phillips Erb at Forbes and discusses the elimination of the penny in 2025.

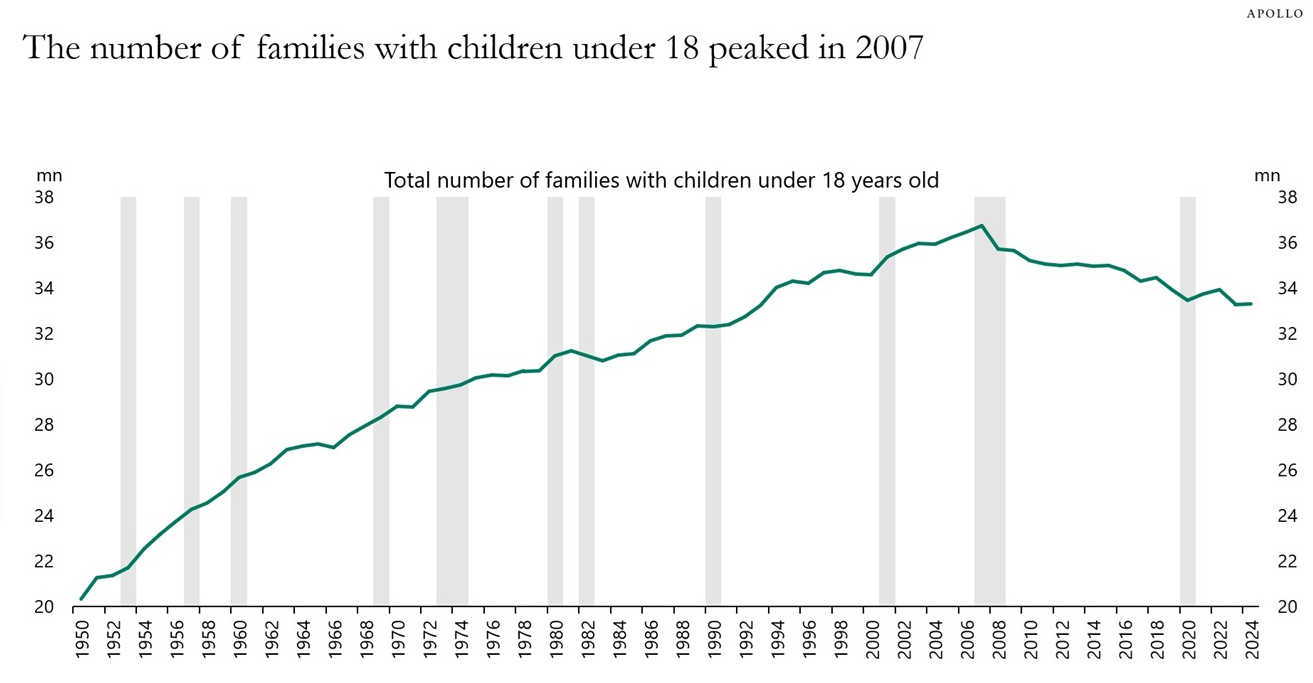

Chart of the Day: Age 18 Peaked in 2007

Today’s Chart from Torsten Sløk with Apollo shows that the number of families with children under the age of 18 peaked in 2007 at 37 million and has..

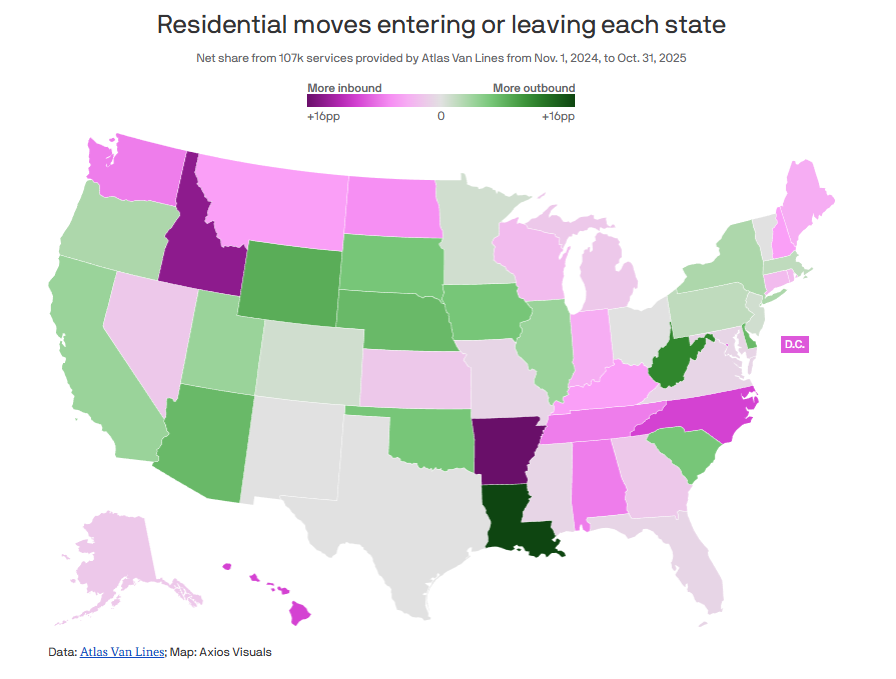

Chart of the Day: Inbound vs. Outbound

Today’s Chart of the Day is from Axios, with data from Atlas Van Lines of their 107,000 residential moves over the last year and shows the percent..

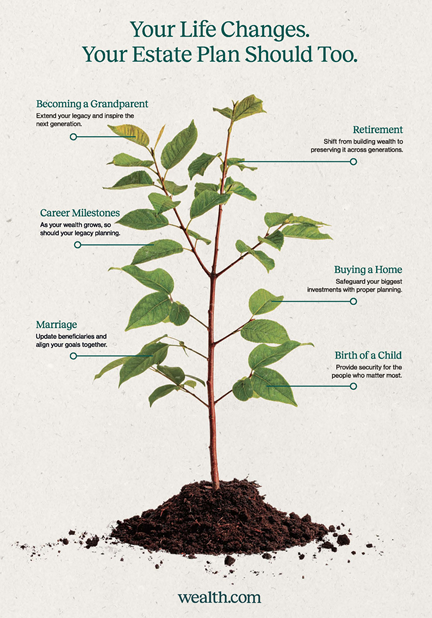

Chart of the Day: Life Changes

Today’s Chart of the Day is from Wealth.com and shows the various reasons why you should revisit (or obtain one if you don’t) your Estate Plan, which..

On Our Minds

Chart of the Day: Housing Inventory

Today's Chart of the day from ResiClub illustrates how today’s housing inventory compares with pre‑covid levels.

Chart of the Day: Average US Retail Gas Price

Today’s Chart of the Day from @CharlieBilello shows the trend of US retail gas prices. Down 43% from the 2022 peak, prices are falling close to a 5-year low.

Chart of the Day: Largest Source of Federal Revenue

With tax season officially upon us, today's Chart of the Day from Liberty Taxed gives us an idea of the projected federal tax revenue over the coming years.

Chart of the Day: Components of GDP Growth

Today’s Chart of the Day comes from JP Morgan Asset Management and highlights the key components of GDP growth.

Chart of the Day: Value of Retirement Assets

Chart of the Day: AI = Improved Productivity + Efficiency

Chart of the Day: US Dollar Dominates

Chart of the Day: Top New Year's Resolutions

Chart of the Day: Net Worth in Stocks

Today's Chart of the Day, shared by dc_economics on Instagram, highlights a shift from historical trends related to household net worth.

Chart of the Day: Estate Plan Updates - When and Why

Chart of the Day: Does it Make Cents?

Chart of the Day: Age 18 Peaked in 2007

Chart of the Day: Inbound vs. Outbound

Chart of the Day: Life Changes

current_page_num+2: 3 -